READ

The number one financial concern for most retirees is whether they’ve saved enough to live a comfortable life in retirement. With so many unknowns – from health, to longevity, to returns – it’s very difficult to calculate a figure that allows you to retire with confidence.

IML’s Equity Income Fund is well suited to help retirees overcome these issues. Its objective is to provide income at least 2% above the ASX 300 on a rolling 4-year basis, with lower volatility. It has more than achieved this objective to date, delivering income of 9.4% pa since inception in 2011 including franking, compared to 5.9% pa for the ASX 300 over the same period[i].

IML’s Equity Income Fund is now available as an ETF (ASX: EQIN)

Our new, actively-managed ETF Investors Mutual Equity Income Fund – Complex ETF (ASX: EQIN) is a new class of units in the IML Equity Income Fund. It invests in stocks with sustainable and often growing dividends, and employs conservative options strategies to take advantage of share market volatility to simultaneously target higher income, with lower volatility.

Why focus on higher income and lower volatility?

Retirees face more financial risks than savers (accumulators):

- Stability matters because withdrawals in times of volatility can lock in losses- downside protection is critical

- Retirees can’t rebuild savings through contributions / buying the dips

Mitigating these risks for income investors:

- Prioritise lower volatility for better downside protection

- Prioritise income to minimise the need for forced withdrawals at inopportune times

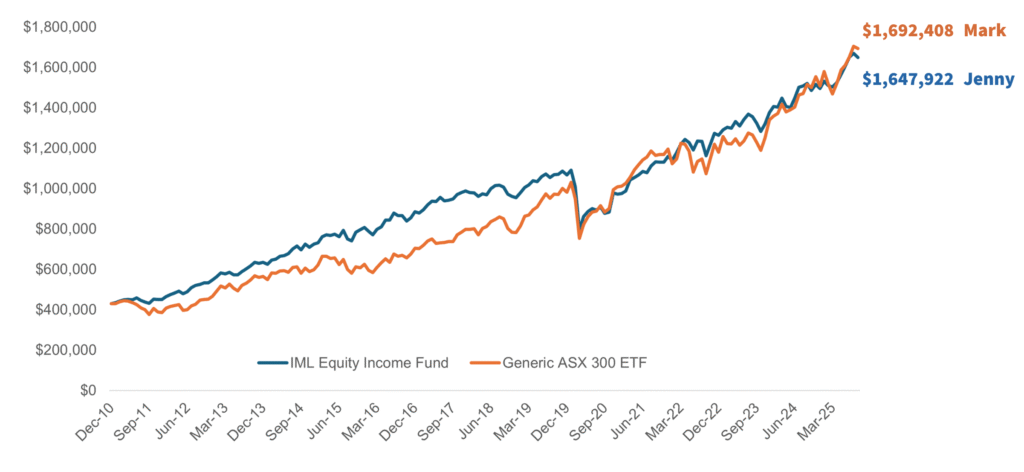

Hypothetical scenario: Mark and Jenny retire at the end of 2010 with a lump sum of $430,000 the amount ASFA recommended at the time for a ‘comfortable retirement’

- Jenny invests the full amount in an income-focused equity fund (IML’s Equity Income Fund – EIF)

- Mark invests in a generic passive ETF[ii] which replicates the ASX 300, with quarterly distributions

If no money was withdrawn from these savings, by the end of September 2025 both Mark’s and Jenny’s lump sum grew to well over $1.6 million.

Source: IML, Factset as of 30 September 2025. Total return is EIF 8.1% p.a. and generic ETF[ii] 8.6%p.a. Returns calculated after fees and including franking [iii]. Past performance is not a reliable indicator of future performance.

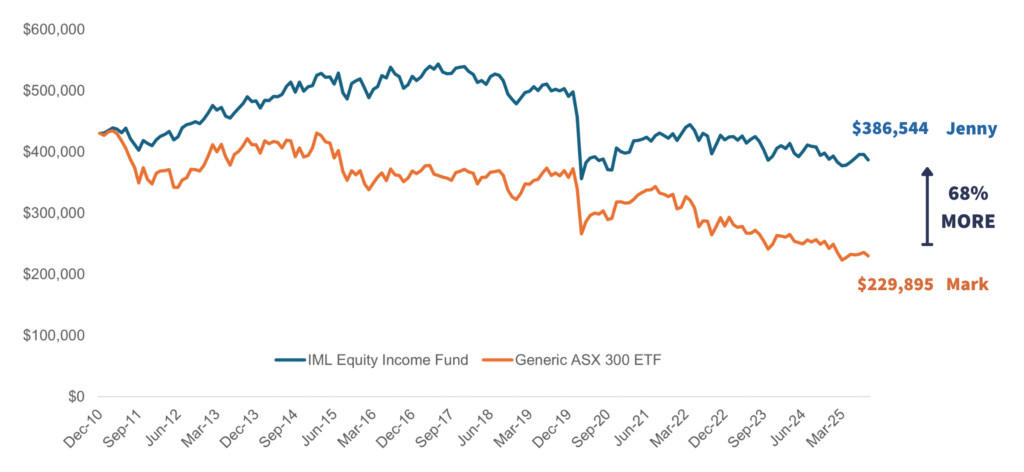

The situation changes drastically when Mark and Jenny make regular monthly withdrawals.

Let’s look at what happens when Mark and Jenny draw money out every month to pay for a ‘comfortable lifestyle’ in line with ASFA’s guidance.

- They draw out $3,275 per month starting in January 2011

- Keep drawing money out each month, rising with inflation

- Total withdrawals of $629,000 each over 14 years.

Source: IML, FactSet as at 30 September 2025.

Lump sum and monthly withdrawals based on ASFA’s Retirement Standard for a ‘comfortable’ life for a single person as starting on 1 January 2011, date of inception of IML’s Equity Income Fund. Withdrawals increase with inflation. Returns calculated after fees and including franking[iii]

The main reason Jenny now has so much more money than Mark is that she was able to rely on her income to fund her lifestyle, whereas Mark needed to sell down his equity holdings – whatever was happening in the market. When the market dropped, Mark STILL had to sell, so locking in his losses, losses he was never able to recover from.

For more about how higher income can make a big difference to retirement savings over time:

Watch On Demand Download case study

[i]Past performance is not a reliable indicator of future performance. Performance quoted in this material is for the Investors Mutual Equity Income Fund (unquoted class) since inception 1 January 2011 to 30 September 2025. Source IML. Equity Income Fund performance is the performance of the unquoted class of units and may be a useful reference point for the newer quoted class of units in the Fund (Complex ETF). However, you should be aware that the quoted class of units in the Fund is new and has no performance history. The past performance for the unlisted class of units in the Equity Income Fund is NOT the past performance of the Complex ETF. There is no guarantee that the investment objective will be realised or that the Fund will generate positive or excess return.

[ii] The fees and franking for EIF are on the EIF Fund page on the IML website. The generic ETF was created by taking the median performance, franking and fees from 4 different passive index funds which track the ASX200 or ASX 300. The index funds used are A200 (betashares), IOZ (ishares), STW (State Street) and VAS (Vanguard).

[iii] Performance since EIF inception, 1 January 2011 to 31 September 2025.The generic ETF were calculated using the median of the four funds, A200 (betashares), IOZ (ishares), STW (State Street) and VAS (Vanguard), 5 basis points of fees and 75% franking.

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited AFSL 246830 for the IML Funds and may include information provided by third parties, including Investors Mutual Limited (IML) AFSL 229988 the Responsible Entity and Investment Manager for the quoted and unquoted units in the Investors Mutual Equity Income Fund. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third parties, except for liability under statute which cannot be excluded. This information is general securities information only and does not take into account your personal investment objectives or needs. Applications can only be made by reference to the current Product Disclosure Statement, or through IDPS products that include the Fund. Before deciding to acquire or continue to hold an investment in the Fund, you should consider the information contained in the Product Disclosure Statement in conjunction with the Target Market Determination, available at www.iml.com.au. Past performance is not a reliable indicator of future performance and that no guarantee of performance, the return of capital or a particular rate of return is provided.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.