By Michael O'Neill

READ

Most people would feel that they understand the difference between “speculating” and “investing”, but it’s amazing how often we hear the words used interchangeably. While they might seem similar on the surface, when you dig a bit deeper it’s like mistaking 20/20 cricket and Test Cricket.

If you buy a mining exploration company or tech startup you’ve read about online or on social media, you might feel as though you’ve “invested in the sharemarket”. The truth is that the value of many of these companies is highly uncertain and impossible to measure objectively. Most of them don’t generate income, and are unable to pay dividends to shareholders.

Usually when someone buys shares in one of these types of companies they’re hoping to trade out within 12 months (often sooner!) for a short-term profit. Rather than investing in the long-term prospects of the company, they are speculating on short-term share price fluctuations.

What is the difference between speculating and investing?

Investing is typically a long-term strategy, based on fundamental research, that involves holding assets for years. Warren Buffett famously said that his favorite holding period is “forever”.

Speculating, on the other hand, is usually a short-term strategy that involves buying and selling assets quickly in the hopes of making a short-term profit. It is often based on ‘gut feel’ rather than fundamental research.

These two different approaches typically mean speculating is a higher risk activity – as predicting short-term movements in prices is usually a coin flip – whereas investing is far more likely to produce good returns over the long term.

Buying speculative companies can in some cases be based on “the greater fool theory”. This is where you buy an asset where there is questionable intrinsic value, hoping that someone buys it from you for a higher price. This type of behaviour is common when asset classes are popular and their trading prices have risen sharply. This momentum can give speculators false confidence prices will continue to rise.

We saw this over the last few years with bitcoin and other cryptocurrencies. Cryptocurrencies might be useful, but outside of the underlying block-chain technology, they have no discernable intrinsic value. They can’t be valued objectively and they trade based on faith, rather than fundamentals.

Investing in the sharemarket is based on fundamental analysis and valuation

Fundamental investing in the sharemarket involves taking a long-term approach, and buying a diversified portfolio of quality companies, below their intrinsic value.

Quality companies can grow their profits over time and generate a sustainable and growing income stream. With competent management, good-quality companies will use the cash flow generated and retained in the business to compound their worth.

To illustrate the difference between speculating and investing consider the performance of two companies over the last 10 years.

Brambles and AVZ minerals – a case study of speculating vs investing

Brambles (ASX:BXB) is a transport and logistics company, which manages the world’s largest pool of reusable pallets, crates and containers. AVZ Minerals (ASX:AVZ) is a lithium exploring company that owns rights to a large lithium deposit in the Democratic Republic of Congo (DRC).

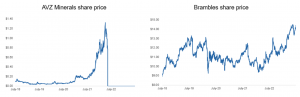

This is a chart of their share prices over the past 5 years, from 1 July 2018 to 30 June 2023:

Source: IML

Brambles has been operating since 1858 and has been publicly listed since 1954. Its share price has appreciated steadily, with fluctuations, reflecting the improvement in earnings and dividends from the business over time. This steady accumulation shows the high quality of Brambles’ business and operations. IML has been a long-term shareholder of Brambles as we think it’s a well-run business, with a dominant market position and strong recurring revenues. Brambles also scores highly on sustainability metrics. It has strong governance, a good social licence to operate and also ranks well environmentally due to its circular business model of re-usable pallets and containers.

AVZ minerals, on the other hand, has had a much more volatile 5 years. Its share price was static from 2018 until the middle of 2021 and then it exploded upwards: going from 16c in mid-2021 to $1.23 in March 2022 as it rode the wave of investor excitement in lithium, without any improvement in earnings or dividends. Then things took a dramatic turn for the worse for AVZ as the government of DRC effectively sold the rights to the lithium deposit it owned. AVZ’s share price plunged, shares were suspended from trading in July 2022 and haven’t traded since. Investors now have their capital locked up in AVZ and are unable to access it. While those shares may potentially be worth something, one day, right now they are effectively worthless.

Speculators speculate, investors invest

Speculating can be a lot like gambling – high risk, high reward. It’s a 20/20 cricket match of big hits and bigger misses where anyone could win on the day.

Investing, on the other hand, is a deliberate approach to steadily compounding wealth over time. It’s a test match – calculated risks, carefully set field positions, a gradual accumulation of runs over a long summer day.

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited ABN 60 088 786 289 AFSL 246830 and includes information provided by third parties, including Investors Mutual Limited (“IML”) AFSL 229988. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third party, except for liability under statute which cannot be excluded. The material is for general information only and does not take into account your personal objectives, financial situation or needs. You should consider, and consult with your professional adviser, whether the information is suitable for your circumstances. Past investment performance is not a reliable indicator of future investment performance and that no guarantee of performance, the return of capital or a particular rate of return is provided. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML. Statements of opinion are those of IML unless otherwise attributed. Except where specifically attributed to another source, all figures are based on IML research and analysis. Any investment metrics such as prospective P/E ratios and earnings forecasts referred to in this presentation constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold that stock. Any commentary about specific securities is within the context of the investment strategy for the given portfolio.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.