By Michael O'Neill

READ

As we head into a new financial year it’s a good time for investors to check whether their investment portfolios are still set up to meet their financial goals. With the economic picture still unclear, sharemarkets volatile, and many companies’ margins under pressure we think it’s a good time to be conservative in asset allocation and invest in quality.

Income is likely to matter more than capital growth for ASX investors

While capital growth will remain important to investors, we think it’s likely to be lower in the next decade than it was for the previous decade. If this is true, then ASX investors are likely to make a greater proportion of their returns from dividends than capital growth over the next decade and so should have a greater focus on stocks with healthy, sustainable (and ideally growing) dividends. Over the last 20 years, 53% of ASX 300 returns came from dividends*.

We have analysed the top companies in the ASX to find our top 5 high-quality stocks with strong prospects for both dividend and earnings growth in the next financial year and beyond. As part of this analysis we looked at dividend history for the past 21 years, including consistency and volatility, as well as the future outlook for each company.

Suncorp (ASX:SUN)

FY 25: net yield 4.6%, gross yield 6.5%, PE ratio 16x**

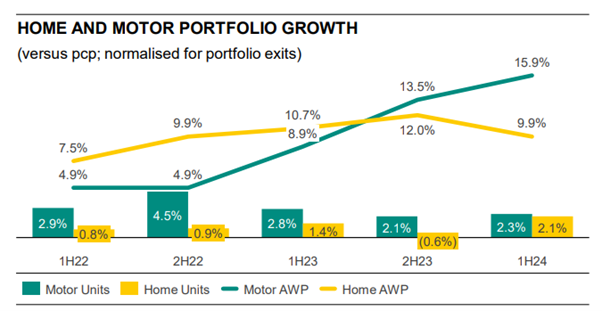

Suncorp is one of Australia’s leading insurance companies with a stable of strong brands which give it a high level of customer retention and pricing power. The large, well-established insurance companies like Suncorp benefit from scale advantages against smaller peers in both home and motor insurance, particularly in terms of supply chain management and flexibility to respond rapidly to disasters and weather events. Suncorp’s business is more heavily skewed to retail home and motor insurance than peers, and the growth in policy numbers and average premiums in these classes is driving improving returns (chart below).

Past performance is not a reliable indicator of future performance. Source: Suncorp, HY24 Results Presentation, 26 February, 2024

We expect Suncorp to continue performing well in the medium term. It has increased insurance premiums but these haven’t yet fully flowed through into profit. The rate at which this increased pricing earns-through is accelerating, which should result in a recovery in Suncorp’s margins. Margin improvement will also be underpinned by higher investment income, due to higher interest rates. Finally, Suncorp has a long, proven track record of returning excess capital. We expect Suncorp to return capital to shareholders early in the next financial year, in the event that the final approval from the Federal Treasurer is granted for the sale of its banking arm to ANZ.

Telstra (ASX:TLS)

FY 25: net yield 5.4%, gross yield 7.7%, PE ratio 19x**

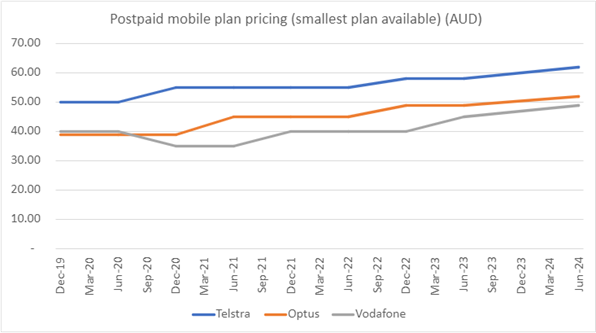

Telstra is the clear market leader in telecommunication in Australia. It has the top brand and the widest mobile network coverage, along with a network of undervalued infrastructure assets within its InfraCo division. Between 2016-2020, the local telco industry went through a difficult period of intense mobile competition that led to a mutually damaging price war. This period is behind it and all participants are now behaving more rationally and increasing prices in a necessary bid to improve their profit margins and returns. As you can see in the graph below, mobile plan prices are increasing, after having declined over the prior decade.

Source: IML, company data, UBS

Communication services is one of the last things that consumers and businesses look to cut back on when money is tight. Telstra’s market-leading position and Australia’s growing population ensure a high level of recurring, growing revenue which has allowed it to pay a consistently high dividend, year after year.

Telstra’s share price fell 10.3% in May after management announced job cuts, mainly in its Enterprise division, and updated customer terms on postpaid mobile plans to remove annual CPI linked price reviews. While the market reacted negatively, we believe this will help Telstra meet its cost reduction target and we are still forecasting mid-single digit profit growth per annum for the next three years. As an industry leader which provides essential goods and services we believe Telstra represents good value and provides an attractive dividend yield in an uncertain economic environment.

Medibank Private (ASX: MPL)

FY 25: net yield 4.4%, gross yield 6.3%, PE ratio 18x**

Medibank is Australia’s largest Australian private health insurer. Like Suncorp, it is benefitting from increased investment earnings, due to higher interest rates. Its strong brands, along with its high customer satisfaction levels, helped it to bounce back quickly after the cyber-attack and start growing customer numbers again in a matter of months.

Its leading market position coupled with Australia’s growing and ageing population, has helped Medibank to grow its customer numbers by around 3% for the past two years. Other societal factors are driving more people towards private health insurance, including the increase in waiting periods at public hospitals. This strong brand and market position gives it a high level of recurring, and growing revenue. This, combined with its conservative balance sheet (with no debt) enable it to pay consistently high dividends.

The Lottery Corporation (ASX:TLC)

FY 25: net yield 3.2%, gross yield 4.5%, PE ratio 28x**

TLC is the largest lottery operator in Australia and operates in all states of Australia except Western Australia. It has long-term, monopoly licenses across both Lotteries and Keno, providing recurring revenue through the economic cycle. The Lottery Corporation (TLC) became an independent business two years ago when it demerged from Tabcorp in May 2022 after much lobbying from us and other shareholders. While TLC has a shorter track record of paying dividends as a separate entity, the steady, infrastructure-like cashflow of the lotteries business should underpin consistent dividends in future.

TLC has a loyal, engaged customer base that continue to use its products regardless of the economic cycle and participation increases significantly when large jackpots occur. It also has good growth prospects as its customers move to digital channels away from traditional newsagents, avoiding a commission payable for physical tickets, thereby improving its margins and dividend prospects. A few years ago around 15% of customers bought tickets digitally, now it’s 39.6%. TLC is also innovating its products and selling these directly to existing customers via e-marketing, giving it a low-cost channel to improve engagement and takeup.

Steadfast (ASX:SDF)

FY 25: net yield 3.0%, gross yield 4.3%, FY 25 PE ratio 20x**

Steadfast is Australia’s largest insurance broker and underwriting agency to small and medium-sized companies (SMEs). Its network of brokers have very strong client relationships and as trusted advisors on essential insurance cover to SMEs their client retention is around 95%. These client relationships, along with the non-discretionary nature of the insurance cover, give Steadfast a high level of recurring revenue through the cycle.

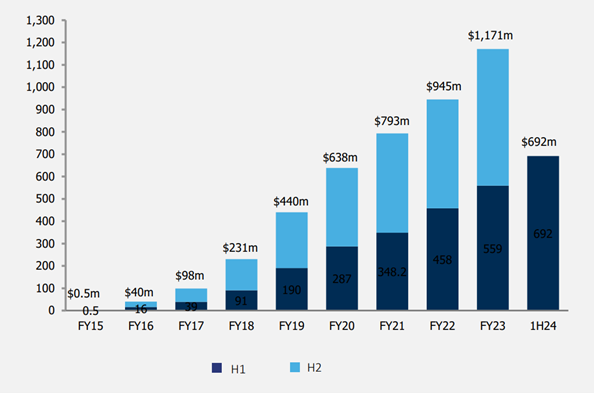

Steadfast has achieved double-digit earnings growth consistently since IPO in 2013 underpinned by continued strong network premium growth, with market share gains in distribution through both brokers and underwriting agencies, and a hard insurance cycle. In addition to this consistent organic revenue growth, it also pursues a highly effective ‘rollup’ growth strategy of acquiring stakes in network brokers.

Steadfast has invested ahead of its peers in technology and distribution and has the leading platform for placement of insurance in the industry. The chart below highlights the strong growth in premiums written through its Steadfast Client Trading Platform. These investments put Steadfast in a strong position to capitalise on longer-dated strategic initiatives both domestically and internationally.

Steadfast Client Trading Platform – Gross Written Premium

Past performance is not a reliable indicator of future performance. Source: Steadfast 1H 24 Results. As at 27 February, 2024

Steadfast has paid a dividend every year since its IPO and has grown its dividend at an average of 14% per annum. We believe it’s likely this strong dividend and earnings growth will continue.

Looking for reliable income with low volatility?

Our Equity Income Fund invests in high-yielding companies , as well as using conservative options strategies, to target income of 2% above the S&P/ASX300 Accumulation Index after fees and before franking, with lower volatility.

Michael jointly manages the IML Equity Income Fund with Tuan Luu.

* Source: Morningstar Direct, as at 31 May, 2024

** Source: All figures are IML estimates as of 21 June 2024 for FY 25, gross yields include franking credits.

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited ABN 60 088 786 289 AFSL 246830 and includes information provided by third parties, including Investors Mutual Limited (“IML”) AFSL 229988. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third party, except for liability under statute which cannot be excluded. The material is for general information only and does not take into account your personal objectives, financial situation or needs. You should consider, and consult with your professional adviser, whether the information is suitable for your circumstances. Past investment performance is not a reliable indicator of future investment performance and that no guarantee of performance, the return of capital or a particular rate of return is provided. You should consider the information contained in the Product Disclosure Statement in conjunction with the Target Market Determination, available at www.stg-imlimited-staging.kinsta.cloud. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML. Statements of opinion are those of IML unless otherwise attributed. Except where specifically attributed to another source, all figures are based on IML research and analysis. Any investment metrics such as prospective P/E ratios and earnings forecasts referred to in this presentation constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold that stock. Any commentary about specific securities is within the context of the investment strategy for the given portfolio. Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.