By Marc Whittaker

READ

Towards the end of 2023 there was a significant increase in M&A activity in the Australian sharemarket. In IML’s small and mid-cap funds an incredible nine of our holdings received takeover offers in this period, including A2B, InvoCare, Probiotec, Symbo and Adbri. This helped contribute to the very strong returns by our small-mid cap funds over the calendar year.

This trend has continued in 2024 with a flurry of takeover activity. There have been high-profile larger-cap deals including CSR and Boral, and the small-mid cap companies held in our portfolios also continue to be targets. Qantm Intellectual Property, an intellectual property law firm, has been the subject of a bidding war while Southern Cross Media has re-engaged with fellow radio player, ARN, in a largely scrip-based deal after ARN made an improved offer. More recently, offshore support vessel operator MMA Offshore also received a bid. The uptick in M&A shows no sign of slowing, and we believe the environment is conducive to further activity.

Why is M&A likely to continue in 2024?

Each deal is driven by its own set of circumstances; however we believe the main factors driving the pick-up in M&A are:

- We are in a low growth environment. The recent reporting season revealed that significant revenue growth is difficult to achieve and likely to remain so for some time. In this environment, companies aspiring to grow need to take the initiative and do something transformational – like making an acquisition in order to add a complementary operation and extract synergies, or entering a new market or geography.

- Interest rates appear to have peaked and are likely to head lower over time. This has given boards and management teams with a solid corporate balance sheet confidence to borrow and commit to M&A.

- Valuations remain attractive – particularly in the small industrials part of the market. Despite the rally we saw towards the end of last year, many small caps trade at discounts to their large cap peers.

- Low Australian dollar. With the AUD low compared to its long-term history, this makes Australian companies more attractively priced for overseas acquirers, particularly if they have operations overseas.

- Growing population. The Australian market remains attractive to many overseas companies given Australia’s high population growth compared to many other developed markets, where populations are in decline or barely growing.

Small cap industrials remain attractive – both for investors and acquirers

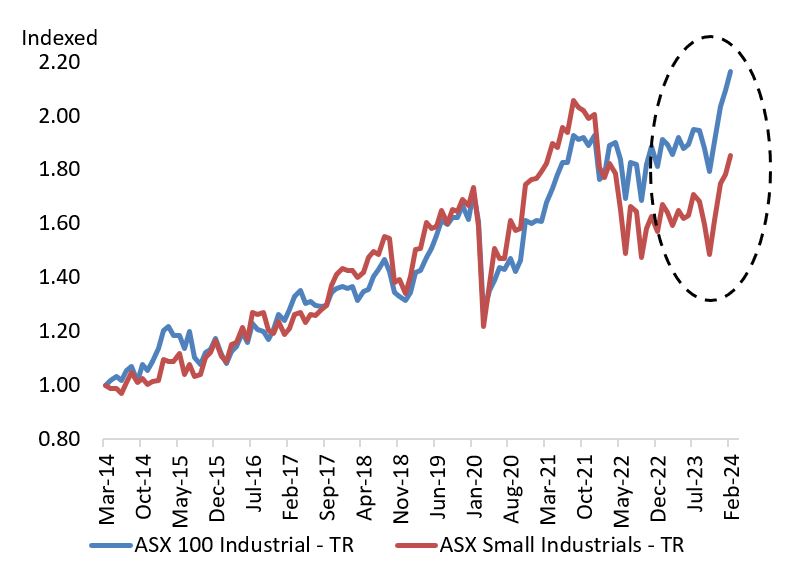

Small industrials had been in a bear market, underperforming the small cap indices and the broader sharemarket since 2021. This started changing in the second half of 2023. With investors becoming more optimistic about market conditions we saw more money flow to smaller companies, with small industrials particularly finding favour. The factors remain in place for this rally to continue.

Source: FactSet; As at 29 February 2024. Past performance is not a reliable indicator of future performance

The companies in our portfolios which have been subject to recent M&A activity are all in different sectors, with very different business drivers, but they share common characteristics. They all have strategic value, which gives them a competitive advantage in their industry, they generate resilient earnings streams, and trade at attractive valuations. This combination of factors makes these companies attractive to corporate or private equity buyers looking to grow or enter new markets.

We don’t buy shares in companies because we expect them to be taken over. However, due to the nature of the companies we buy – quality companies trading at a discount – we do see a lot of our portfolio companies subject to takeover activity. In fact, an acquisition is often the result of suitors seeing value in companies where the broader market hasn’t. And often, once one party makes an offer, other parties express interest and a bidding war can result (as we have seen recently with Namoi Cotton and Qantm).

With that in mind, there are a number of listed small companies held across the IML funds that we believe are candidates for M&A interest in 2024. The key is the strategic positions they hold in their industries, which are difficult to replicate organically, hence why acquirers are interested.

Three companies we believe could be attractive to an acquirer are:

Integral Diagnostics (IDX)

IDX is the 4th largest provider of diagnostic imaging services in Australia. It is benefitting from the long-term growth drivers of Australia’s ageing population and also from advances in technology. These include AI that enables diagnostic imaging to be used earlier and more widely in the diagnosis and treatment of medical conditions.

After a period of high labour cost increases which impacted margins, management is focused on growing operating margins by shifting the mix of scans to higher margin work and taking costs out of the business. With Medicare indexation of services in place, revenue growth has not been an issue. Over time the earnings of IDX will recover as management execute on their plan.

The network of Diagnostic Imaging centres IDX operates, in largely regional areas, form a strong barrier to entry and make the company attractive to a potential acquirer, in a sector which is experiencing rapid consolidation.

Trading on 8x FY25e EBITDA*, IDX is attractively priced compared to recently reported Private Equity or corporate backed transactions in the sector, which have all occurred at well over 10 times EBITDA.

Ridley (ASX:RIC)

Ridley is Australia’s largest provider of bulk animal stock feed and feed ingredients. Market leadership has provided Ridley with scale benefits and the ability to invest in building out a more recurring and less volatile business. Ridley has grown faster than the market by investing in existing assets to drive additional volume and developing higher margin, premium and branded pet food and ingredient products. This is important as the agricultural sector consolidates and participants look to pursue relationships with scale suppliers.

The outlook for animal ingredients is positive as the pet food industry continues to grow quickly underpinned by the “humanisation of pets” trend and the demand for biofuels, which can use animal waste products as an input.

Ridley’s balance sheet has ample capacity to fund this investment, along with acquisitions of its own, as we saw recently with the acquisition of Oceania Meat Processors, a premium producer of frozen meat products for the global pet food industry. Ridley’s valuation is attractive in our view, on 13.5 times FY25 earnings and a yield of 4.4%*.

Bega Cheese (ASX:BGA)

Bega has built a portfolio of well-known and highly-regarded food brands, including Dairy Farmers, Dare and Pura. The company also operates one of the largest chilled-food distribution networks in Australia. Its brands and network are very difficult to replicate and make the company an attractive target for an acquirer.

History shows that Australian branded and unbranded food companies often find favour with overseas acquirers with Tassal, United Malt and Coca Cola all receiving takeover bids in recent history from offshore based suitors (with the first two being held in our small-mid cap funds).

While current year earnings in Bega’s bulk food division have been depressed by a low global dairy price, future year earnings should recover as the global price recovers (which it has done recently). Given the strong cashflows food companies can generate, EBITDA multiples are the best way to compare valuations. Bega trades on 8 times FY25 EBITDA, which is a discount to the normal multiple for global food peers which typically trade on 10-12 times.

When selecting stocks, think like an acquirer

As mentioned before, we don’t buy shares in a company because we think it’s likely to be taken over. We buy companies for the same reasons we always have: competitive advantage, recurring earnings, capable management, the ability to grow earnings and dividends over time and, critically, a reasonable price. However, there’s a lot of overlap between why we buy shares in a company and why someone might want to buy the entire business. For investors looking at which stocks to invest in it can pay to think like an acquirer: if the market doesn’t recognise the value you’ve identified, someone else just might!

Looking to increase your small-mid cap exposure?

IML was named by Morningstar Australia as a 2024 finalist for Fund Manager of the Year – Domestic Equities – Small Caps (for the Investors Mutual Small Cap and Investors Mutual Future Leaders Funds) find out more.

Find out more about IML’s Future Leaders Fund

*IML estimates, as of 19 March, 2024

Morningstar Awards 2024 (c). Morningstar, Inc. All Rights Reserved. Investors Mutual Small Cap and Investors Mutual Future Leaders as 2024 Finalist for Fund Manager of the Year – Domestic Equities – Small Caps, Australia

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited ABN 60 088 786 289 AFSL 246830 and includes information provided by third parties, including Investors Mutual Limited (“IML”) AFSL 229988. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third party, except for liability under statute which cannot be excluded. The material is for general information only and does not take into account your personal objectives, financial situation or needs. You should consider, and consult with your professional adviser, whether the information is suitable for your circumstances. Past investment performance is not a reliable indicator of future investment performance and that no guarantee of performance, the return of capital or a particular rate of return is provided. You should consider the information contained in the Product Disclosure Statement in conjunction with the Target Market Determination, available at www.stg-imlimited-staging.kinsta.cloud. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML. Statements of opinion are those of IML unless otherwise attributed. Except where specifically attributed to another source, all figures are based on IML research and analysis. Any investment metrics such as prospective P/E ratios and earnings forecasts referred to in this presentation constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold that stock. Any commentary about specific securities is within the context of the investment strategy for the given portfolio. Any reference to a ranking, a rating or an award provides no guarantee for future performance results and is not constant over time.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.