By Michael O'Neill

READ

It has been encouraging to see markets, and investors, in a more positive mindset over the last couple of months. Inflation has been tamed in many parts of the world and interest rates look to be at or near their peak. However, there are reasons for caution in 2024.

According to The Economist, Australia has the most entrenched inflation of any OECD country and the geopolitical environment also remains unpredictable. It’s likely that in 2024:

- Markets will remain volatile

- Interest rates, and costs, will remain elevated

- Consumer demand will be sluggish.

In these economic conditions margins will be under pressure for many companies. For us this reinforces our view that, over the coming years for Australian investors:

- Capital growth is likely to be lower than for the last decade

- Income remains likely to make up a greater share of total return than capital growth.

Where to allocate for income in 2024?

While we like the prospects for income, which income asset class should investors allocate to?

- Term deposits and bonds are looking more attractive than they have in recent years. The ability to get a return of 4-5% with low risk is a valid option, however investors need to be aware that returns at these levels are close to the level of inflation (so minimal ‘real returns’) and money is often locked up for multiple years, with hefty penalties for early exits.

- Property is also worth considering, but risks remain around valuations.

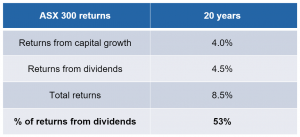

- Equities remain an important source of income for investors, with the ASX 300 returning 4.5% p/a of income over the last 20 years, but equities are an inherently riskier asset class, so investors should seek ways to mitigate this risk.

As always, income focused investors should diversify their investments to manage risk. With inflation still above the long-term average in Australia, and predicted to remain that way until the end of 2025, we think investors should consider an allocation to equities to give them the best chance of achieving above inflation returns and protect their spending power and quality of life.

Which equity income stocks should investors consider?

Investors in Australian equities have received more than half of their return from income over the past 20 years, so dividends and income are one of the key considerations for most of IML’s funds, particularly the Equity Income Fund which I am co-portfolio manager for.

Source: Morningstar Direct; as at 30 Nov 2023

Income varies dramatically by company, so to maximise income, investors should look for companies that pay consistently high dividends, year after year, rather than cyclical companies where dividends often fluctuate with economic cycles. We find that high-quality industrial companies tend to best fit this profile. Specifically, we look for companies which:

- are industry leaders (number one or two in their industries, with a clear competitive advantage);

- with defensive earnings (the ability to continue to generate consistent revenue, and profit, through all stages of the economic cycle);

- growing dividends (long-term consistent dividend payers, with dividends growing over time, showing capable management and quality capital allocation); and

- have a strong balance sheet (relatively low debt, a healthy free cash flow and strong asset backing).

Top 3 stocks for income in 2024

When we consider the factors above, as well the stage we are at in the economic cycle, and likely economic landscape in 2024, three companies stand out to us as great income prospects. All of the companies below have options that are tradeable on the ASX, with which our Equity Income Fund can comfortably generate an extra 2-3% of income a year.

1. Medibank Private (ASX:MPL)

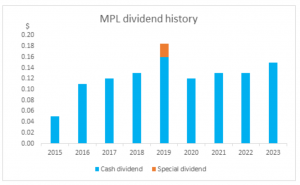

Medibank is Australia’s largest private health insurer. It has bounced back strongly from last year’s cyberhack with its Net Promoter Scores (a key measure of customer satisfaction) recovering quickly and policy holders growing at around 2% p/a. It has a strong balance sheet, with no debt, and is actually increasing profit margins through these challenging economic times, mainly by generating extra income from the interest it is earning by investing customer premiums. Medibank has also shown a great ability to pass through higher costs to its customers over the past year, while still increasing overall customer numbers.

Australia’s ageing population has an increasing need for medical care and even when money is tight medical care is one of the last things to get cut from household budgets. As the industry leader, Medibank stands to benefit from these structural growth tailwinds, particularly as government investment in public healthcare remains constrained. This continued growth should be able to help it continue its strong dividend history, as seen by the chart below.

Source: Morningstar Direct, as at 30 December 2023

Medibank is trading at a valuation of 17 times FY 24 earnings, and has a yield of 4.6%.

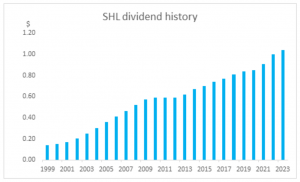

2. Sonic Healthcare (ASX: SHL).

Sonic is an industry leader in medical diagnostics and the number one pathology business in Australia, Germany, Switzerland and the UK and number three in the USA. It benefitted from a boost to revenue and profits during Covid, which provided a significant uplift to its balance sheet and left it with little debt. This strong balance sheet has it well placed to continue to grow through acquisitions, as it has done in the past. While the Covid boost has now tailed off, Sonic is well placed to continue to benefit from the good growth prospects in healthcare. The diagnostic imaging sector also tends to be resilient throughout the economic cycle. As you can see by the chart below, Sonic has an exemplary record of continuing to grow dividends for 20+ years.

Source: Morningstar Direct, as at 30 December 2023

Sonic is currently trading on a valuation of 22.5 times FY 24 earnings with a dividend yield of 3.4%.

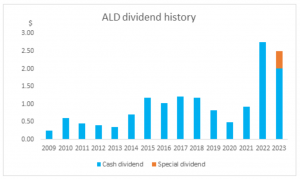

3. Ampol (ASX:ALD)

Ampol (ALD) is the industry leading refiner of crude oil in Australia. It’s very capital intensive to build an oil refinery and with refining viewed as a ‘sunset’ industry due to the global transition to renewable energy it’s unlikely there will be any significant new competitors to Ampol’s oil refining business in this region. Ampol is also well placed to benefit from the trend towards increased sales of non-fuel retail through its large network of strategically placed property assets. In countries like Norway, where the transition to EVs is much more advanced, sales from non-fuel retail have increased, partly due to longer dwell times as customers re-charge their vehicles.

A relatively recent change to government policy has also made refining more attractive. Due to gasoline’s strategic importance, no country wants to be totally reliant on overseas imports. The Australian government introduced a new policy which effectively means that refiners are guaranteed a positive margin. So, while Ampol can still earn an attractive margin under the right conditions, effectively it cannot run at a loss, which will enhance its returns through the cycle. Ampol has a strong balance sheet backed by strategic infrastructure and significant property assets and generates significant free cash flow. It also has a great track record of paying dividends, as you can see from the chart below:

Sources: Factset, Morningstar Direct, Ampol’s company reports

Ampol is currently trading on a price to earnings ratio of 11 times FY 24 earnings and a yield of 6.8%. While stocks linked to fossil fuels are priced at a discount because of ESG concerns, we know oil in some shape or form will be around and in use for decades, which makes Ampol attractive right now.

2024 and beyond looks good for income investors

As I look ahead to 2024 and the years to come, while I’m not as bullish as some of the more feverish commentators I am very positive about the prospects for income. If you’re an investor that relies on income to maintain your lifestyle I think you should seriously consider evaluating your allocation to equity income this year, to give you the best chance of achieving the income you want for your lifestyle.

Looking for reliable income and capital growth with low volatility?

Find out more about our Equity Income Fund.

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited ABN 60 088 786 289 AFSL 246830 and includes information provided by third parties, including Investors Mutual Limited (“IML”) AFSL 229988. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third party, except for liability under statute which cannot be excluded. The material is for general information only and does not take into account your personal objectives, financial situation or needs. You should consider, and consult with your professional adviser, whether the information is suitable for your circumstances. Past investment performance is not a reliable indicator of future investment performance and that no guarantee of performance, the return of capital or a particular rate of return is provided. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML. Statements of opinion are those of IML unless otherwise attributed. Except where specifically attributed to another source, all figures are based on IML research and analysis. Any investment metrics such as prospective P/E ratios and earnings forecasts referred to in this presentation constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold that stock. Any commentary about specific securities is within the context of the investment strategy for the given portfolio.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.