By Michael O'Neill

READ

Banks and resources companies might hog the headlines when they have windfall profits and offer super-sized dividends, but they’re not where the most consistent income lies. Investors that want regular, long-term income, to avoid drawing down on their capital should look to high-quality industrial companies. They tend to pay the most consistent dividends over time and so offer the best chance of consistent income to fund your lifestyle, while still growing your initial capital over time.

As I mentioned in a previous article, dividends are a very important part of Australian investors’ return, they’ve made up more than 50% of the returns from the ASX 200 over the past 20 years. They’re also more reliable than capital growth, are less volatile, and tend to perform better during times of low economic growth. For all these reasons we think dividends are likely to return the lion’s share of returns for the next decade, so it’s a great time to focus on income and dividends.

Here’s three qualities that we think most commonly feature in these high-quality industrials that pay consistent dividends, with some current examples from the ASX:

1. Recurring earnings

This is one of the key things we look for in a ‘quality’ company, it’s part of our investment philosophy and has been since IML started more than 25 years ago. Companies with a high level of recurring earnings are more predictable, and are unlikely to suffer from the same booms and busts as cyclical companies.

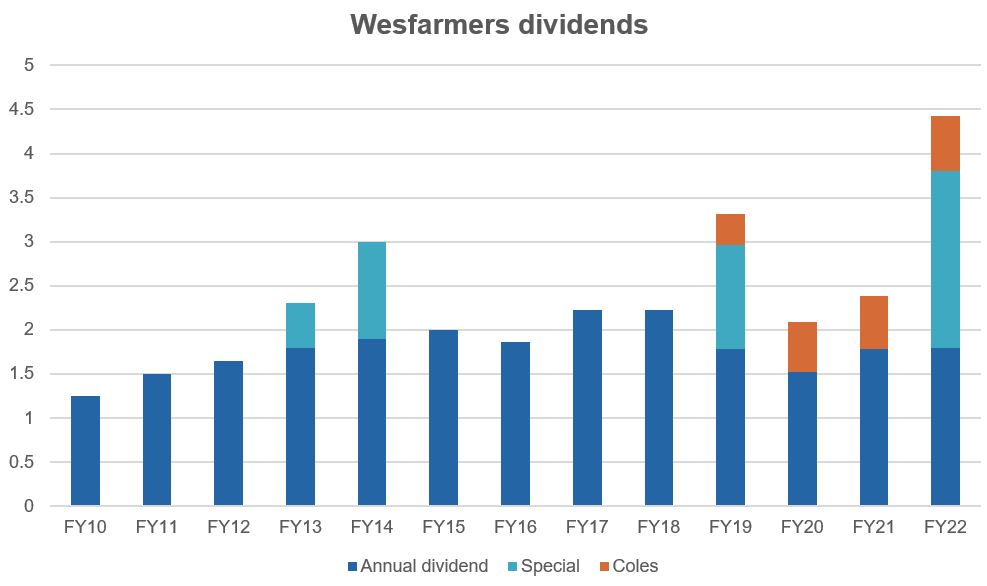

Putting valuation aside, a good example of this is Wesfarmers (WES), particularly the Bunnings franchise, which represents around 70% of its valuation. Bunnings is a very high-quality franchise which continues to go from strength to strength, generating strong, and increasing, cashflow. It is dominant in its industry and has become a part of popular culture and embedded in its communities with its DIY mentality, motivated staff and beloved sausage sizzles.

It continues to grow its earnings and dividends by rolling out more stores, broadening its product range, and improving its margins. The overall Wesfarmers dividend has benefited greatly from the Bunnings growth engine, and Coles which was demerged in late 2018.

Source: Bloomberg, 26 May, 2023

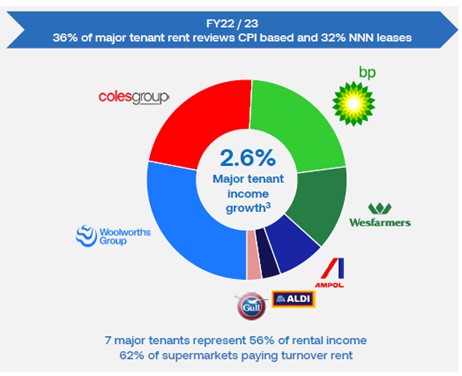

Another good example is Charter Hall Retail Real Estate Investment Trust (REIT) – ASX:CQR. We are cautious on the REIT sector overall as we think that valuations don’t yet reflect higher interest rates, however there’s always an exception to the rule and for us it’s CQR. It has a high-quality, growing rental stream – 56% of its rent comes from supermarkets and petrol stations and 44% from largely non-discretionary specialty tenants.

Source: CQR 1H23 result presentation, 16th Feb 2023

One of the key things we’re looking for right now is how well companies cope with high inflation, do they have the pricing power to be able to pass on higher costs to customers? Charter Hall is well placed in this environment as 42% of its rent is directly or indirectly linked to CPI, and another 40% of its tenants receive 4% fixed annual increases. Its occupancy rates are also very high, they have been at 97-99% for 20 years, including during Covid, and its rents have grown 2-3% pa consistently for 20 years. All of these factors add up to consistent, recurring earnings.

2. Capable management

A great management team is another key feature we look for in a quality company.

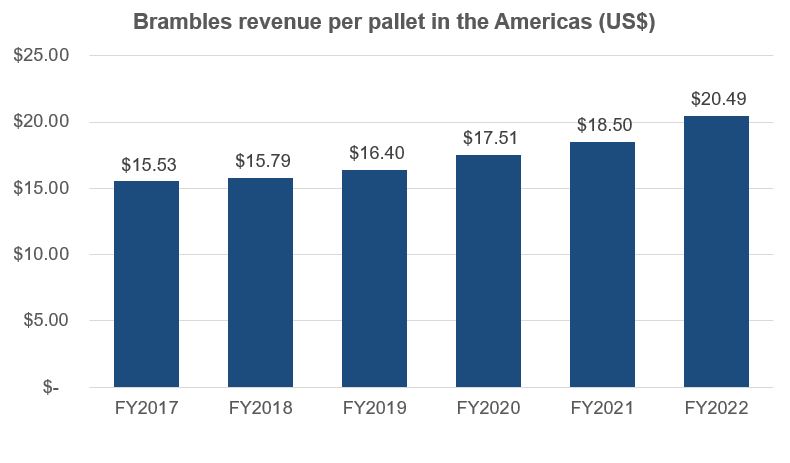

A prime example of this is Brambles, a long-term holding of ours where we think management has done a stellar job. The current CEO, Graham Chipchase, has been in the role since early 2017 and his team has significantly improved the profitability of the business over that time as well as reduced earnings volatility. The CEO is well supported by the Brambles board, led by John Mullen as Chair. Mullen has a strong history of leadership in logistics as well as a distinguished board career, and has helped to drive a strong culture of continuous improvement.

One example of these improvements can be seen in Brambles’ Americas division, which was the poorest performing division when Chipchase joined the company. Chipchase and his management team put in place a series of measures to improve margins and the overall revenue it earned per pallet in the Americas.

Source: Brambles disclosures and IML analyst estimates

Brambles management has also improved contract terms with customers to more effectively price the true cost to serve their customers, as well as implementing new cost inflation measures (e.g. lumber and transport surcharges) that have helped improve the company’s profitability. Chipchase has also shifted costs from being fixed to more variable in nature to reduce operational gearing and earnings volatility. He has also focused the company on its core business by divesting low-margin non-core businesses.

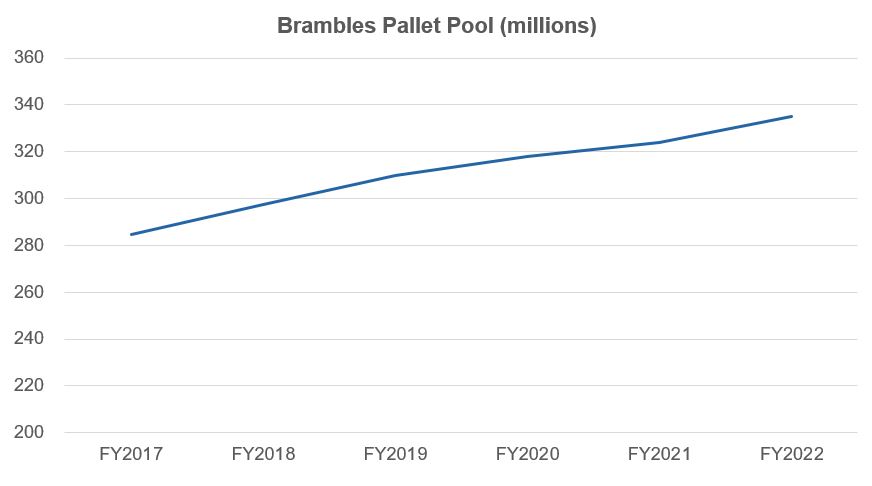

Brambles success since Chipchase started in 2017 can be seen in the consistent growth of its pallet pool over the last six years as well as its underlying EBITDA margin expanding by approximately 4% over this period.

Source: Brambles disclosures and IML analyst estimates

3. Reinvesting profits for growth

Another key trait of these long-term high dividend payers is sensible management of cashflows and balance sheet, which facilitates strategic reinvestment of profits. Companies that overpay dividends relative to profits or stretch their balance sheet too thin don’t have this luxury, and underinvestment will ultimately result in weak earnings growth and / or unsustainable dividends.

Two great examples here are Sonic Healthcare (SHL) and Amcor (AMC).

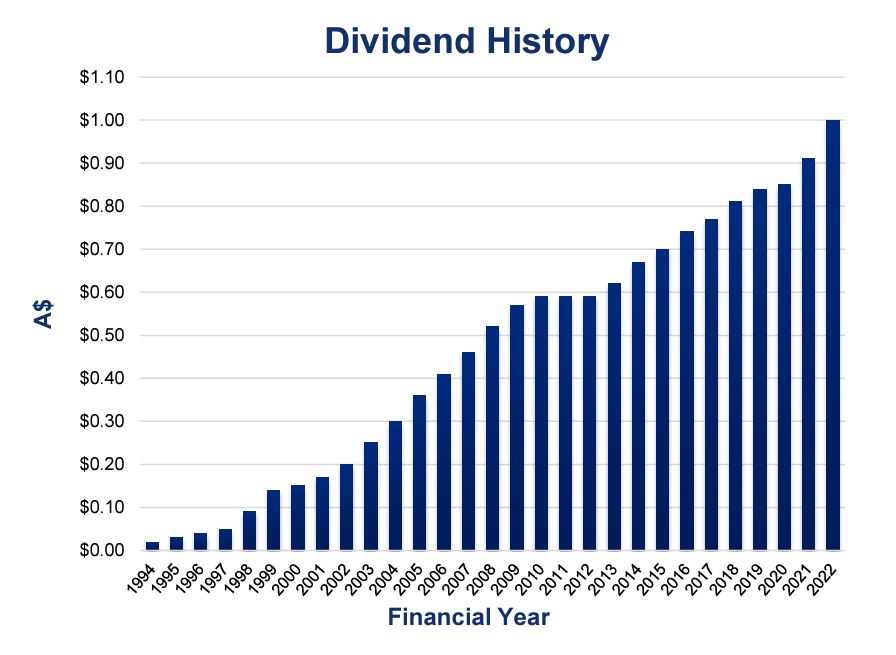

Sonic has consistently retained around 30% of its earnings to fund growth, either through capital expenditure or M&A. It has also backed itself and made some big growth leaps by raising equity every few years for larger, company transforming M&A. The success of this strategy can be shown by the way it has continued to increase its dividends to shareholders for the last 30 years – it really is an impressive track record of dividend growth.

Source: Sonic Healthcare: FY22 results presentation

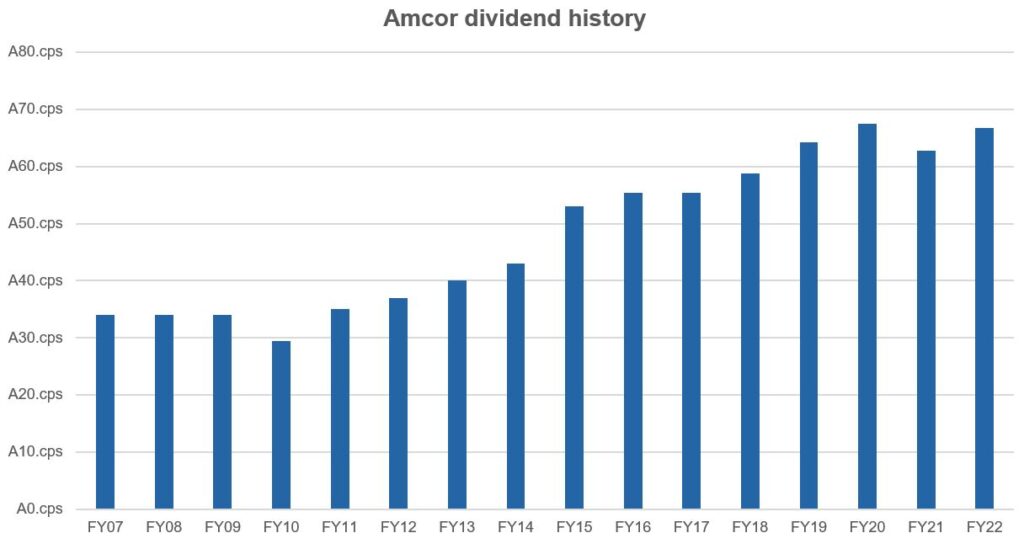

Looking over the long-term, Amcor (AMC) has a dividend history, that speaks for itself.

Source: Amcor financial reports, IRESS data (30 May, 2023)

One of the key drivers of this dividend history has been the way it has bolted on other businesses to its core business over the years, in niche or adjacent packaging businesses, to continue to fuel its growth. On average it has retained around 30% of its earnings over the years to be able to continue to afford these bolt-ons. It also made a couple of big acquisitions where it needed to raise equity funding – Alcan from Rio Tinto in 2009 and then Bemis in 2019. These acquisitions were very successful, transforming the business and driving further growth.

Looking for reliable income and capital growth?

Check out our Equity Income Fund

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.