By the IML Small and Mid Cap team.

READ

Despite the negativity that pervaded most of last year, the small cap market ultimately managed to deliver solid returns in 2023. A rally late in the year saw the ASX Small Ordinaries up +7.8% for the calendar year, with the Small Industrials up +11.4%.

This rally followed several years of underperformance by small caps (companies outside the top 100) generally, and industrials in particular. This underperformance started during Covid and was exacerbated by higher interest rates. Now that these headwinds are dissipating and uncertainty is abating, small cap industrials have begun to recover somewhat relative to large caps.

Despite the recent rally we think small caps are still well placed for growth this year. Small cap valuations remain attractive compared to large caps with superior earnings growth forecasts*. On an individual stock level there remain plenty of quality small cap industrials trading at attractive valuations.

Why small caps have lagged for the past five years

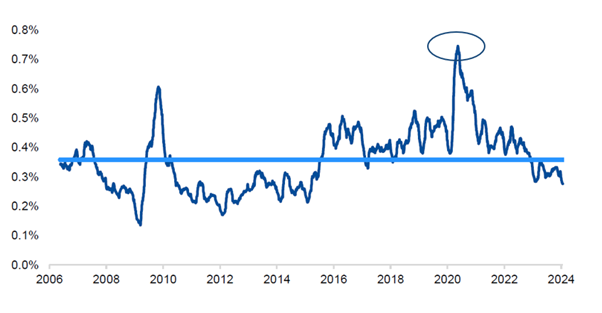

The Covid pandemic caused a massive disruption to all our lives and indeed the markets. Smaller companies, in general, saw a bigger impact on their operations and profits than larger companies. The volatility in earnings resulted in large share price movements causing many to abandon the small end of the market, seeking refuge in large caps. This can clearly be seen in the chart below which shows trading activity in small caps peaking during the early stages of Covid, with a continual decline since.

ASX small industrials – daily trading value % market cap

Source, Morgans, IRESS, Bloomberg. Data as at 22 Jan 24.

While for most people the pandemic is increasingly feeling like a distant memory, the same is not true for many companies. The lagged impact of pandemic policies meant that it was not until the 2023 August reporting season that management teams were able to report a post-Covid “normalised” earnings result and provide guidance reflecting a more stable operating environment. This helped build confidence with investors.

Higher interest rates also weighed on the small cap market from 2021 to 2023. Then, in late 2023, when fears of further interest rate increases receded, and talk of rate cuts started to emerge, bond yields declined from their peak. With the economic outlook stabilising, interest rates declining from their peak and small-cap valuations looking attractive, many small industrial companies posted strong gains in late 2023. Corporate activity also picked up in small caps at this time, further helping sentiment. Given the discounts available, acquirers were able to offer significant premiums to market prices and still make the acquisition attractive to their own stakeholders. IML’s Smaller Companies Fund directly benefitted from this takeover activity, receiving bids for six of our holdings in the final three months of 2023 alone!

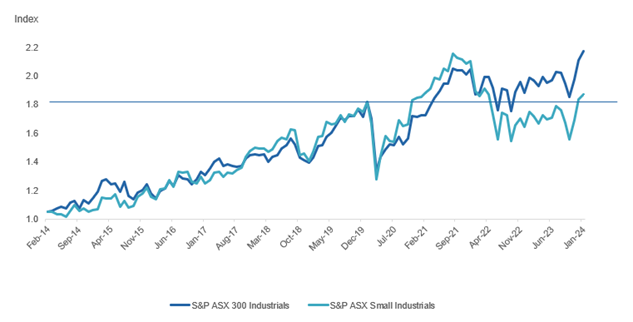

However, while small industrials have rallied strongly from the lows, the chart below clearly shows that there is still a large performance gap between small and large industrials.

Performance of large industrials vs small industrials (last 10 years)

Source: Factset, total return, as at January 31, 2024

The chart also shows how small cap industrials have only just risen above their pre-Covid peak, while large industrials are well above pre-Covid levels. With Bloomberg’s growth forecast* for small industrials well ahead of the forecast for the ASX 200 Industrials, this would indicate that small industrials can continue to close this performance gap. With Covid having washed through the economy, and the interest rate outlook stabilising, two of the major headwinds over the last few years for small industrials have abated.

Three small caps well positioned for growth

Three stocks which we think are currently well positioned, attractively priced and well placed to grow earnings, despite the ongoing cost pressures in the economy, are Kelsian, ACL and SG Fleet.

Kelsian (ASX: KLS)

Kelsian operates bus services across Australia, Singapore, the UK and, following the recent acquisition of All Aboard America, in the US. The Australian, Singapore and UK operations are underpinned by long term government contracts. Effectively the earnings under these contracts are inflation-protected, providing a defensive earnings stream with growth coming from new bus routes and generating efficiencies.

The US business operates under multi-year contracts with major corporates, again with no patronage risk borne by the company. Its competitive position is underpinned by the ownership of strategically located depots in the fast growing south-west of the country. Kelsian also operates a smaller marine and tourism division, which operates ferries and tourism assets in Australia. With several of the marine operations having long term essential service contracts and the increase in domestic tourism benefiting the tourism assets the outlook for this division is favourable.

With the revenue significantly contracted, recent tender wins in Sydney and the initial contribution of All Aboard America, Kelsian is well placed to deliver solid earnings growth in FY24. Further upside in FY25 is possible from further public bus contract wins in Australia and the UK, as well as bolt-on acquisitions in the USA. Kelsian’s valuation is conservative in our view, on 15 times FY25 earnings** and a yield of 4%.

Australian Clinical Labs (ASX:ACL)

ACL is one of three national pathology operators in Australia. Its operations are underpinned by a modern unified laboratory system which allows it to manage workflows efficiently, maximising utilisation and operating margins. This came to the fore during the pandemic when volumes fluctuated significantly due to Covid testing. During this period, it was able to maintain margins by carefully managing costs while maintaining a high response rate.

Australia’s ageing population ensures ongoing growth in testing volumes, as older people are more likely to have health issues requiring regular monitoring. The number of conditions able to be assessed by pathology testing continues to grow, also underpinning growth in volumes. These factors have seen industry testing volumes grow 5% pa, over the past three decades. However, recent “business as usual” volumes have been slower to recover to trend than expected due to doctor shortages and cost of living pressures. History indicates that these growth rates are likely to return to trend over time.

ACL has a strong balance sheet with minimal debt, providing scope for further bolt-on acquisitions. A merger with larger peer, Healius, was entertained by the company recently but has been withdrawn given Healius’s poor trading update in late 2023. The synergies from such a merger are significant, making a future transaction an attractive opportunity (subject to regulator approval). Trading on only 13.5 times FY25 earnings and a yield of over 5%**, we believe ACL is attractively priced.

SG Fleet (ASX:SGF)

SG Fleet is Australia’s largest automotive fleet leasing provider, with operations in the UK and NZ. The company is effectively an asset manager of large corporate fleets and has benefitted from the gradual outsourcing of fleet management services across government and corporate. SG Fleet also operates a novated fleet-leasing operation in Australia, which is benefitting from recent government initiatives to promote electric vehicle (EV) take-up in Australia.

SG Fleet’s contracts are multi-year and provide a mix of recurring and one-off revenue as vehicles within the fleet are renewed over time. It has a strong history of renewing contracts and is the leader in adding services to its customers, for example “telematics” has been introduced more recently to allow remote monitoring of fleets which assists clients in increasing utilisation.

SG Fleet acquired competitor Leaseplan in 2021 and has been working to combine the operations since. Once complete in 2025, management has guided to significant synergies being attained, particularly from integrating IT systems

Earnings in recent years have been impacted by a lack of supply of new vehicles and elevated trade-in values. These factors have overshadowed recent results, creating noise in the results and hence creating uncertainty for investors, weighing on the share price. However, with a solid balance sheet, and significant upside from the Leaseplan acquisition we believe any uncertainty around these factors is excessively factored into the share price. SG Fleet is very attractively priced, trading on under 10 times FY25 earnings and a dividend yield of over 7%**

———————————————————————–

All of these companies have the characteristics we look for in our quality and value mantra, which we have been following consistently since we started more than 25 years ago. They have strong competitive positions, are capably run, with a high degree of recurring earnings and a solid growth outlook. And crucially, all are reasonably priced.

Looking to increase your small cap exposure?

IML’s Smaller Companies Fund delivered a +22.3% return before fees in 2023, ahead of its benchmark, the ASX Small Ordinaries index (ex-property), which returned +9.0%. It has delivered a return of +12.5% per annum since inception***, ahead of its benchmark which has returned +5.7% over this period.

IML has been named by Morningstar Australia as a 2024 finalist for Fund Manager of the Year – Domestic Equities – Small Caps – find out more.

Find out more about the IML Smaller Companies Fund

* Bloomberg, earnings per share (EPS) growth forecast, as of 2 February 2024.

** As of 2 February, 2024

*** As of 31 December 2023. Fund Inception: 30 June 1998. Past performance is not a reliable indicator of future performance.

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited ABN 60 088 786 289 AFSL 246830 and includes information provided by third parties, including Investors Mutual Limited (“IML”) AFSL 229988. IML is the Responsible Entity of the Investors Mutual Australian Smaller Companies Fund. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third party, except for liability under statute which cannot be excluded. The material is for general information only and does not take into account your personal objectives, financial situation or needs. You should consider, and consult with your professional adviser, whether the information is suitable for your circumstances. Past investment performance is not a reliable indicator of future investment performance and that no guarantee of performance, the return of capital or a particular rate of return is provided. You should consider the information contained in the Product Disclosure Statement in conjunction with the Target Market Determination, available at www.stg-imlimited-staging.kinsta.cloud. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML. Statements of opinion are those of IML unless otherwise attributed. Except where specifically attributed to another source, all figures are based on IML research and analysis. Any investment metrics such as prospective P/E ratios and earnings forecasts referred to in this presentation constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold that stock. Any commentary about specific securities is within the context of the investment strategy for the given portfolio.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.