READ

After a volatile first four months of the year as the world adjusted to having Donald Trump as US President again, share markets have been on a steady climb since with increasing risk appetite. While these returns have of course been welcomed by investors, the further markets go up, the more concerns rise about when they will pull back.

If risk is elevated, it might seem like a terrible time to introduce options into your portfolio, however according to Tuan Luu, who is portfolio manager for IML’s Equity Income Fund alongside Michael O’Neill, this is because many people don’t really understand how options work:

“A lot of people, even very experienced fund managers and investors, their minds just blank out when you talk about options. It’s almost a funny thing: it’s like people just don’t want to understand them for some reason.”

With that in mind we asked Tuan whether there was any truth to the three most common ‘myths’ we hear about options.

1. They’re risky.

While it’s true that options can be risky by magnifying losses through adding leverage, it’s also true that options can be used to reduce risk. As Tuan says:

“Options are a tool, and like many tools you can use them for whatever you want. You can use them for speculation, and yes that is risky, but that is more for traders. For IML, as long-term investors, we use options in a different way. We have a conservative, vanilla approach that only uses exchange-traded options, not over-the-counter options which are more complex and can have higher counterparty and pricing risks .”

Tuan integrates options into IML’s underlying investment process, which he calls ‘Getting paid for buying and selling shares’. The options are set at levels that the Fund would buy and sell stocks at anyway. As Tuan explains:

“When we sell a put option it is underwritten by real cash in the fund. When we sell a call option on a stock, we actually own that stock and are happy to sell it at that price. When options are used in this way then we can only ever lose money that we have, not beyond that.”

2. They make your returns more volatile.

A common refrain is that options add extra volatility to your portfolio. That they help you to win big, but also lose big – like supersizing the equities rollercoaster. For Tuan this ties back into the way options are used: if options are used to speculate, then inevitably they add volatility.

Options can also be used to deliberately reduce the level of volatility in a portfolio. To do this options can be used as a ‘hedge’, to offset potential losses in another investment, similar to taking out insurance for your car or your house.

There is also a third way, the way Tuan uses them, where options are incorporated into an investor’s buy and sell discipline. When used in this way they naturally reduce volatility, as the price fluctuations of individual stocks are reduced. As evidence of this Tuan points to the track record of the Equity Income Fund:

“Over nearly 15 years, almost every single quarter our volatility has been lower than the index. On average the market is around one-third more volatile than we arei.

On a theoretical basis, it’s actually very hard for us to add extra volatility as the only way to do this is to breach the constraints we have set around the fund, or add leverage, neither of which we ever do.”

3. That options swap capital for income.

Options can be a very useful tool for earning income. The more call options you sell, the more income you generate. This leads to the thought that options boost income at the expense of capital – that if you consistently use options it will deplete your capital and leave you continually having to buy in and out of stocks. There are certainly some funds and some investors that follow this approach, writing a large amount of options to generate as much income as possible.

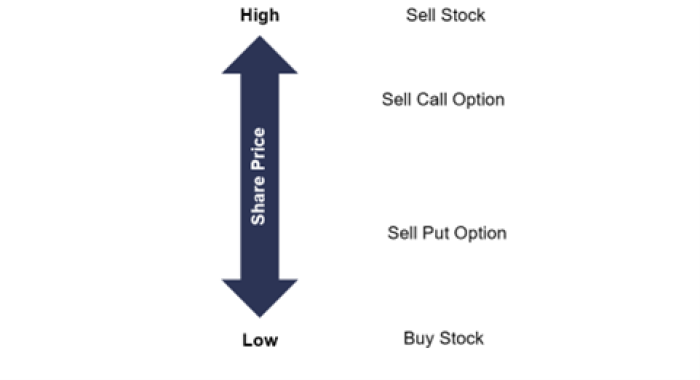

However, this is not the approach that Tuan follows. He integrates the use of options into IML’s investment process and to meet the goals of the fund as explained in the graph below.

IML Equity Income Fund – options buy/sell discipline

The Equity Income Fund aims to deliver net income of 2% above that of the ASX 300ii, so Tuan sells enough options to meet this goal, and no more. This is because while income is important to investors, total return is also important and Tuan does not want to sacrifice total return for the sake of income. He says:

“Capital, income and options are a constant trade off. You can bring forward the promise of capital growth as income, but it’s a choice you make, and it’s a question I ask myself every single day to try to get the balance right.”

There are two main, interlinked guidelinesiii Tuan follows to try to get this balance correct:

- Sell call options above the price paid for the stock. So, if Telstra shares were bought for $4, he would try to sell call options above $4. The exception to this rule is if a stock has fundamentally deteriorated and a decision is made to sell, or reduce exposure to, that stock.

- Sell options in line with the buy and sell decisions of the fund. In line with the above, do not sell options just for the sake of maximising income, but use them as an integral complement to the natural buying and selling process of the Fund.

Options CAN BE a good fit for conservative investors

Many of the stories you hear about options are worst case scenarios – bad times make great stories. But using options in a prudent way to complement a long-term investing strategy will never be a riveting story to tell over a drink.

Options can reduce risk, while potentially increasing returns and incomeiv. They can also provide flexibility in many types of market conditions and reduce the volatility of your returns. As Tuan says:

“Many people tell us that options are not the right fit for conservative investors, or that they’re not the right fit for retirees who need to live off their savings. In fact, we believe the exact opposite is true. A conservative options strategy can be the perfect fit for a conservative investor.”

Tuan Luu jointly manages IML’s Equity Income Fund and its associated ETF (EQINv) with Michael O’Neill. He is also portfolio manager for IML’s Private Portfolio Fund, alongside Marc Whittaker.

i Source: IML, since inception 1 January 2011, to September 30 2025. IML Equity Income Fund annualised standard deviation is 10.1% compared to 13.1% for the ASX 300 Accumulation Index. Past performance is not a reliable indicator of future performance.

ii Please refer to the Product Disclosure Statement and Target Market Determination available at iml.com.au/funds/equity-income-fund/#documents

iii The examples below are for illustrative purposes only.

iv All investments carry risk. Your investment can move up and down, and there is no guarantee of returns or income.

v Please refer to the Product Disclosure Statement and Target Market Determination available at iml.com.au/funds/equity-income-fund-etf/#documents

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited ABN 60 088 786 289 AFSL 246830 and includes information provided by third parties, including Investors Mutual Limited (“IML”) AFSL 229988. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third party, except for liability under statute which cannot be excluded. The material is for general information only and does not take into account your personal objectives, financial situation or needs. You should consider, and consult with your professional adviser, whether the information is suitable for your circumstances. Past investment performance is not a reliable indicator of future investment performance and that no guarantee of performance, the return of capital or a particular rate of return is provided. You should consider the information contained in the Product Disclosure Statement in conjunction with the Target Market Determination, available at www.iml.com.au. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML. Statements of opinion are those of IML unless otherwise attributed. Except where specifically attributed to another source, all figures are based on IML research and analysis. Any investment metrics such as prospective P/E ratios and earnings forecasts referred to in this presentation constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold that stock. Any commentary about specific securities is within the context of the investment strategy for the given portfolio.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.