By Ally Selby, Livewire Markets

WATCH

READ

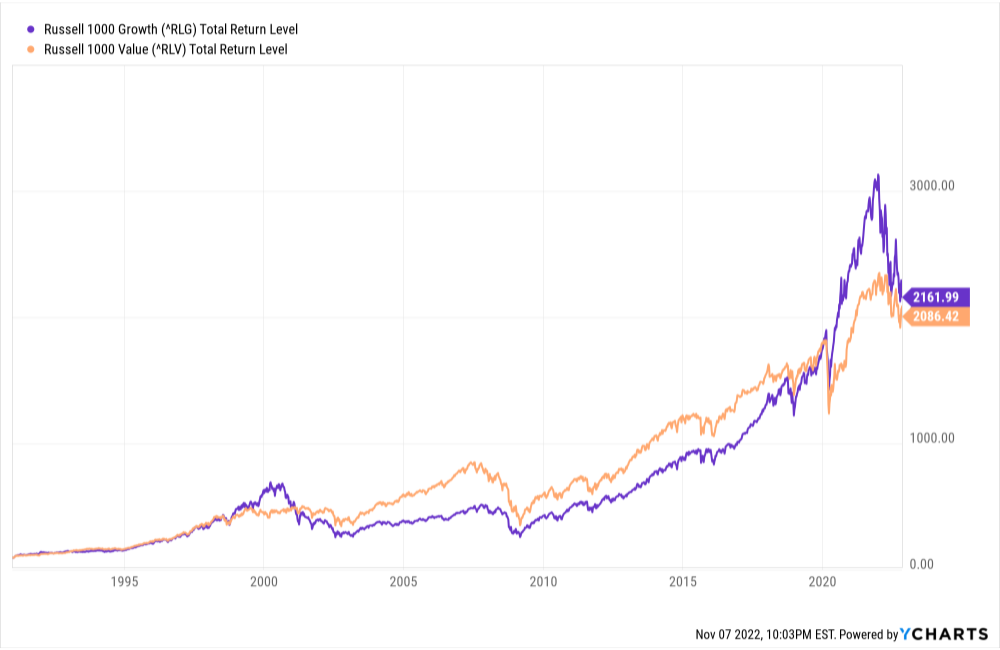

It is a truism of markets that value outperforms growth over the long term. Sure, growth stocks have enjoyed their time in the sun in recent years, pumped up by a decade of low interest rates and the roaring success of the tech sector. But really, this outperformance is only a blip compared to value’s long-term run.

Now, with the macroeconomic environment swinging once again in value’s favour, growth stocks have been shunned for their more defensive peers – a shift that Anton Tagliaferro, the founder of Investors Mutual Limited, knows all too well.

“The most amazing period for me when I look back is when I set up IML in 1998,” he recalled.

“Of course, we had the tech boom in 1999 and 2000, and there I was, having set up a value fund and looking for companies with fundamentals and going around talking to financial advisers about how good companies like Amcor and Woolworths and Brambles were.”

Back then, the market was “consumed and obsessed” with companies like Davnet and One.Tel – once darlings of the local share market – as it has been with many of the great growth stories of recent years (like Afterpay, for instance). But like all overvalued bubbles, the good times, eventually, came to an end.

“A lot of advisers would say things like, ‘You don’t get it, mate, the world’s changed,’ or ‘You don’t get it, mate, you’re past your use-by date’,” Tagliaferro said.

“And then, of course, the tech boom unravelled in 2000 … In a period of 12 months, we went from everyone bagging us, threatening to pull their money out (although we didn’t have much money under management then, to be honest) to within a year or two winning fund manager of the year. And that was the making of IML.”

As value once again enjoys a resurgence, the investing veteran has announced he will be stepping down from his role at the helm of IML, leaving portfolio managers Simon Conn, Hugh Giddy, Daniel Moore and Michael O’Neill to lead the firm’s quality and value-focused small and large-cap portfolios.

But before he leaves the professional investment world for good and starts his journey as a private investor in March, we were luckily given the opportunity to speak to Tagliaferro one last time (although, he says he isn’t going anywhere and will likely continue to be a major market commentator. So this probably isn’t the last you will hear of the value investor).

In this interview, you’ll learn about the most consistent, resilient performers during his career, where he is seeing value right now, and why he still hasn’t been lured in by the now heavily discounted Aussie tech sector.

Plus, he also shares what makes this market downturn different to those of the past, as well as why he believes central banks are still behind the curve.

Why central banks are still behind the curve

Livewire last sat down with Tagliaferro back in October 2020. While others were enjoying the fruits of governments and central banks’ labour – benefiting from the cheap money that was flooding the global economy, Tagliaferro warned we could see a rise in inflation down the track.

As it would turn out, he was correct. For the twelve months to September, monthly CPI rose to 7.3% in Australia. In the US, the inflation print is running at 8.2%. For some context, these are the highest levels of inflation seen in approximately three decades.

“Certainly, when you look around the world and you look at where the rate of inflation is and when you look at the cash rate, most central banks are well behind [the curve],” Tagliaferro said.

While the Fed has been “very aggressive”, and Europe is “getting there slowly”, Australia is still lagging behind the pack, he said.

“I think the RBA has been extremely cautious and extremely slow. And they may be right, but they’re also potentially taking a big risk that inflation becomes embedded. They may have to [hike] aggressively again as we go into 2023,” Tagliaferro said.

That said, the issue isn’t that this downturn is different, per se. It’s that central banks’ bark is now worse than their bite.

“Central banks used to be completely independent and quite ruthless when things like inflation turned up,” Tagliaferro said.

“Nowadays, they seem to be very willing and able to cut rates to zero when there are times of trouble or turmoil or when financial markets need a boost. But we’re seeing now when inflation is very high, at 40-year highs, they’re really dragging their feet in terms of putting rates up.”

So what’s the outlook on the pathway for central banks from here? Well, Tagliaferro believes that there is some hope that inflation will come down rapidly at some point.

“Obviously, the oil price isn’t going to double again… And the supply chain disruptions may sort themselves out. So there are signs that some parts of what’s caused high inflation are coming off,” he said.

“But on the other hand, we potentially have an issue with wages. While unemployment is low and the cost of living has gone up so much in various parts of the world, people are going to rightly want more wages, which in itself is inflationary.”

In addition, it doesn’t help that the Australian dollar has fallen rapidly in recent months and that we import most of our goods. Meaning, we are likely going to suffer through higher prices in the next few months.

“I think there is still a bit of water to go under the bridge,” Tagliaferro said.

“When you look at how equity markets have reacted in the last few weeks, I think they’re already assuming that inflation’s going to come off and that rates won’t have to go too high, and at some point, they’re going to start coming down.

“There is a risk to that scenario. Inflation could prove to be a bit more sticky, and wages growth could come through. And in Australia, we have the additional problem of the lower dollar causing price rises. Inflation may be a lot stickier than what central banks are assuming.”

Simon Conn and Anton Tagliaferro on day dot of IML.

Where Anton Tagliaferro is seeing value (and spoiler alert: it’s still not tech)

While 2022 has been a notable year for a slew of reasons, the one thing that certainly will remain in investors’ minds is this – it’s been a good year for energy and a very, very bad year for tech.

Since the beginning of the year, the S&P/ASX All Tech Index has fallen 33%. Energy, on the other hand, is up a whopping 46%. But even that derating in tech is not enough to lure in a seasoned value investor like Tagliaferro.

“If you look at the Australian tech sector, there aren’t many good quality companies, to be honest,” he said.

“Their valuations are still relatively high. We’re seeing a few takeovers in Australia of some tech companies, which is probably a good sign, but I’d still be cautious of the tech sector here in Australia.”

In the US, on the other hand, household names like Facebook/Meta Platforms (NASDAQ: META) and Alphabet/Google (NASDAQ: GOOGL) are extremely profitable and have come down 40-70%.

“These are extremely valuable global brand names generating huge cash flows with cash on balance sheets,” Tagliaferro said.

“Some of those are probably beginning to look interesting from a long-term point of view.”

So there’s not a single quality tech company in Australia? I asked (somewhat desperately). Well, Tagliaferro concedes that IML does own “a few”. He points to Infomedia (ASX: IFM) as his pick of the bunch but reiterates that Australia continues to come up short compared to the US.

So if not tech, where is Tagliaferro finding value? Well, with the recent rally (bear market bounce or not), it’s become more difficult to uncover the gems, he said. But Aurizon Holdings (ASX: AZJ) continues to impress.

“It has very stable revenues. Okay, coal is a bit on the nose in Australia. The rest of the world seems very happy to consume our coal … But Aurizon has long-term contracts,” he said.

“Obviously, the coal sector’s doing very well, so its customers are doing very well, which helps when you’re negotiating prices. And Aurizon has a very good management team.”

Aurizon has been busy expanding into moving bulk commodities – such as iron ore, cement, bauxite, alumina, base metals, grain, livestock, and fertiliser.

“Coal is in long-term decline over the next 20-odd years, so their plan is to use the cash flow from their coal haulage to expand the bulk operations,” Tagliaferro added.

He also pointed to GUD Holdings (ASX: GUD) as a recent purchase on share price weakness.

However, until we know how badly impacted the global economy is going to be in 2023, it’s quite difficult to accurately assess company earnings, Tagliaferro said, making it ever the more difficult to value companies and ultimately, be an investor in this day and age.

The IML team accepting the Money Management/Lonsec Fund Manager of the Year 2012 award for Australian Equities.

The most consistent performers from Tagliaferro’s career

Tagliaferro pointed to Amcor (ASX: AMC) as a long-term, resilient performer, despite its fair share of “ups and downs” over the last 20 years. From 1986, when he first looked at the company, Amcor has since expanded from being a domestic packaging and paper company to being one of the largest packaging giants in the world.

“There were times when I owned it when people would say, ‘Why do you own it? It’s a bit of a dog.’ But Amcor, through luck or good management, has made a couple of very good acquisitions in the last 10 to 12 years,” he said.

“They took over the Alcoa assets in 2009, right at the bottom of the cycle for a very cheap price. That really helped their growth. And about three or four years ago they took over Bemis and extracted another $200 million in synergies.”

He also pointed to Sonic Healthcare (ASX: SHL) as another all-time great.

“Sonic Healthcare started off with a couple of pathology labs in Australia. They expanded those over time. They have had the same management team there for the last 33 years,” Tagliaferro said.

“They’ve gone from basically a few labs in Australia to becoming the dominant pathology provider in Australia with 50% share… They’re now the number one pathology provider in Germany, Belgium, and in the UK. Number three in the US. And that was from two or three labs in Australia.”

And a few anecdotes about the man himself

While Tagliaferro has had a storied career – having been inducted into the Hall of Fame in 2005 and just this year, earning an Order of Australia for his services to the charitable and investment sectors, he’s surprisingly humble.

The recognition is “nice”, but he doesn’t dwell on it. He just gets back to doing what he loves most – investing. And while he is stepping away from his role at the helm of the investment manager he founded back in 1998, he’s not giving up on investing altogether.

“I’m a value manager. It’s in my blood to buy good quality stocks at the right price,” he said.

“Hopefully, that legacy I’ve built is now part of the fabric of IML, and they’ll continue to do that. But that’s the way I’ve always looked at stock markets. And going forward, in a private capacity when I manage my own money, that’s how I’ll look at it.”

He’s not going to suddenly start investing in momentum or jump on the latest trend. Tagliaferro is steadfast that he will continue to search for good quality companies, with recurring earnings and good management teams at the right price.

And yes, in case you were wondering, Aurizon, with its quality assets, cash flows, management and current valuation, will have a place in his personal portfolio.

So what does Tagliaferro know now that he wished he knew starting out?

“One of the things that has been a big surprise in the last 20 years has been how strong the resource sector has been,” he said.

“I remember back in the ’80s and early ’90s, the iron ore price was $20 a tonne. And the price used to be set every quarter.”

Back then, there were only three Australian iron ore producers – North Limited, Rio Tinto, and BHP, he recalled.

“I don’t think anybody then would’ve ever dreamt of the iron ore price getting to $100 a tonne or $150, or $80 or $90 or a $100 and staying there for long periods of time,” Tagliaferro said.

“And besides that, I think Australia in those days used to export 100 million tonnes of iron ore. Today we export over a billion tonnes. So it’s been a tenfold increase in volumes and a fivefold increase in prices, which has just been incredible.

“So if I knew then what I know now about the iron ore price, it would’ve probably been a very good place to invest.

Newspaper clippings featuring Tagliaferro at his finest.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.