By Hugh Giddy

READ

These are unprecedented times. Even the use of the word unprecedented seems to be commonplace now. Never in peacetime have entire communities been restricted in movement and association, many willingly. Interest rates have been set at zero or less around most of the world, sitting well below inflation virtually everywhere. Government and private debt have skyrocketed.

Investors and speculators have cheered these unusual conditions. Equity markets keep setting records in many parts of the world, commodities have been bid up, house prices have increased at a blistering pace despite effectively zero migration, and the crypto sphere has drawn many devoted fans who are impervious to the lack of official backing or income, and who don’t mind that there is no way of assessing value, or arguably value other than zero. The most unpopular asset is cash, perhaps understandably because of the financial repression of central banks who are clearly unwilling to match interest rates to inflation, let alone allowing savers any real compensation for their frugality.

The longer such conditions persist, the more normal they begin to feel. Speculators believe the central banks are too scared to let the economy suffer from a major correction in markets (the “Fed put”), homebuyers are comforted by the fact that so many others have borrowed more than they can easily repay and assume the government will try to rescue housing, and the woeful returns from holding cash make conservative people feel they simply have no alternative but to join the party.

There is no question we have been in a very powerful bull market for a wide range of assets, arguably since the lows of the Global Financial Crisis, or GFC, in 2009, despite the brief covid panic of early 2020. Easy money is the essential justification for buying financial assets, “there is no alternative” (TINA) to doing so. In a lengthy bull market often the best assets to own are the most speculative, as mature companies providing dividends and cash flow limit the imagination more than the promise of untold riches that might eventuate from start-ups or popular (but unprofitable) companies.

Panic among buyers

As custodians of our clients’ retirement savings, it is imperative that we keep our wits about us. We cannot be lured into abandoning our investment disciplines and chasing fads. We are never tempted to use new valuation metrics or approaches (page views, addressable market size, management proforma unaudited profits that are irreconcilable to cash flows, celebrity endorsements of stocks, handing money to companies without knowing how it is to be used, and so forth). You may chuckle, but the amount of money risked on such flimsy foundations is breathtaking.

People tend to associate panic with sharp market declines. A cool head may help you to avoid selling at the lows and to take advantage of bargains as others panic in response to bad news or just the fall in prices itself. However, in recent times the panic has been amongst many buyers, plunging headlong into fads and trends as they are consumed by fear of missing out (FOMO) and propelled by stories of other people making a killing in some speculative asset. As the Spectator noted in 1890, “Nobody is so silent as the unsuccessful speculator. And nothing gets abroad so quickly in a limited society as a happy stroke on the Stock Exchange.” Social media has created a platform for intense FOMO, with novice speculators sometimes displaying more confidence than experienced professionals. Indeed, many seasoned investors become ridiculed in the media for their failure to appreciate the new opportunities and fads that so many novices have unearthed or simply followed.

It does seem counter-intuitive to assert a buying panic. Surely people act more emotionally when they are losing money, possibly forced to sell because of margin calls. Buying a new position can be done coolly and based on a considered expectation of likely returns. After all, if you don’t buy your situation does not really change. What might change is the asset in question goes up and your regret at not buying is inflamed as you hear of others who have been fortunate enough to have bought in. Fear of missing out becomes a powerful reason to buy, regardless of valuation.

To some, it may seem to be a new era because of zero interest rates. “This time is really different”, unlike all the previous occasions when things were thought to be different but turned out not to be.

Market valuation in rare territory

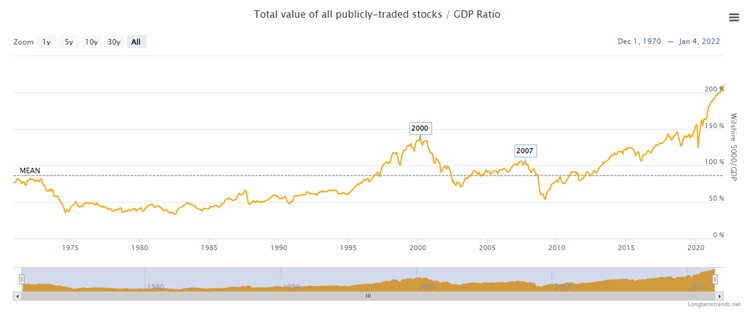

If interest rates are zero, and real interest rates are materially negative (-4 to -6 percent is common in developed countries), owning real assets like stocks that grow or pay income is obviously more satisfying than watching your purchasing power be whittled away by central bank credit largesse and inflation. Hence current valuations are considered to be justifiably higher than usual, although the correct valuation for a market can never be pinpointed. Nevertheless, the chart below of market value to GDP shows that we are in rare territory in the world’s major economy, the USA, well above the extraordinary folly of the Dotcom boom of 2000.

There are numerous indicators that show investors are almost universally bullish. There will always be a few people expressing caution, nevertheless at present these investors are often more fully invested than usual because of pitiful returns on safe alternatives.

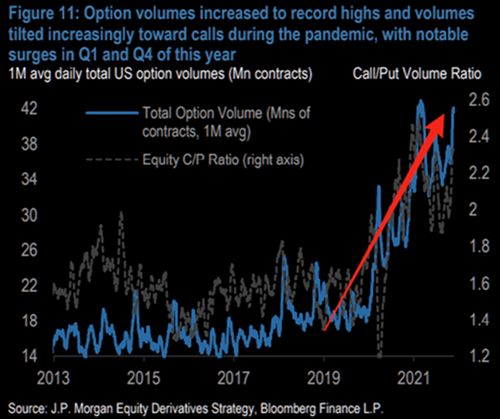

In the options markets, call buying is about 2.5 times the volume of put buying, the highest level in decades. Calls represent a bet the underlying stock will go up and a put is a bet on a stock price fall.

Notably, over 50 percent of options traded by retail investors have an expiry of one week or less, reflecting a feverish level of speculation by retail punters and great business for options market makers who take the spread.

Money has poured into IPOs, on a scale dwarfing the bubbly conditions of the tech boom, following a record year for raising money in 2020. In the US, unprofitable company IPOs exceeded profitable company IPOs by more than a tenfold ratio (based on trailing earnings, of course the future is always forecast to be rosier). The interest in unprofitable companies is not limited to the USA. Evans and Partners have calculated that about 10 percent of the Australian market index represents unprofitable companies.

Interest in investing has soared

Retail investors have flocked to the market, with people abandoning their existing jobs amid the “Great Resignation” to become daytraders. Social media platforms and chat rooms allow people to exchange tips, to promote stocks to others which may allow the promoter to sell advantageously, and to engage in strategies to push up prices of heavily shorted stocks by squeezing the shorts into covering at high prices. Fundamentally questionable companies such as Game Stop, Blockbuster video and AMC Cinemas are among a group of “meme stocks” that became famous for this, with some novice investors thinking AMC Cinemas might be Amcor.

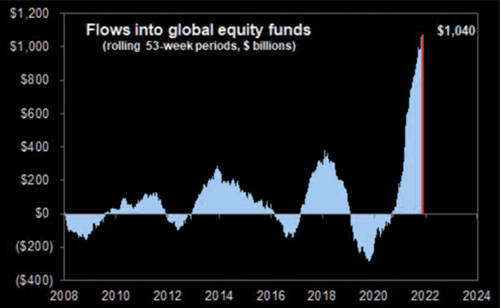

Not only have accounts at retail brokerages been mushrooming, interest in getting into the market through funds has soared. Flows into global equity funds for the past year exceed the cumulative flows of the past two decades.

There has been a huge trend to passive investing with index-tracking and thematic exchange traded funds (ETFs) booming. This is a manifestation of an underlying bullishness, as passive investment means buying more of some stocks as they become more expensive, while largely avoiding sizable positions in cheaper names, a strategy that is unlikely to perform as well as a selective quality or defensive portfolio in a downturn. Buying an ETF (that isn’t actively managed) means buying a region or a theme, without regard the underlying companies’ quality.

At IML, we have plentiful experience of booms and busts, and know that we need to stay true to our philosophy and investment discipline. We cannot become excited alongside the “thundering herd” of bulls, participating in fads and themes which are superficially appealing but fundamentally highly speculative.

As equity investors we nevertheless always participate in the market. Fortunately, we are still able to find and own companies that appeal to us despite a very frothy backdrop. As detailed on our last roadshow, there are several companies with strong franchises and attractive valuations that had barely moved despite strong markets, such as Telstra, Brambles, Amcor, Orica and AusNet. AusNet has subsequently been bid for at a pleasing premium, and the value in Telstra’s infrastructure and strong mobile position has begun to attract buyers.

We remain excited about the opportunities in our portfolios, despite scratching our heads at the obscene valuations and speculative intensity in other parts of the market. We have already seen signs of rationality returning. For example, share prices of companies in the inevitably crowded ‘buy now pay later’ space have more than halved from their highs. The future is always unknown, but our long-term confidence in our portfolios of quality, defensive companies is strong.

Senior Portfolio Manager & Head of Research Hugh Giddy is a portfolio manager for the IML Australian Share Fund and the IML Concentrated Share Fund.

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (AFSL 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to buy, sell, or hold that stock. Past performance is not a reliable indicator of future performance.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.