READ

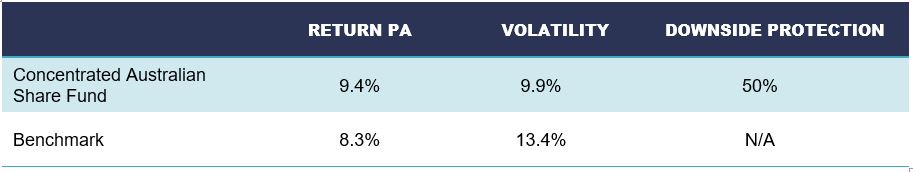

IML’s Concentrated Australian Share Fund (Quoted Managed Fund) is now directly available to investors for the first time after listing on the ASX on 1 August, 2023 (ASX:IMLC). The fund has performed 1.1% p/a better than the ASX 300 Accumulation Index since inception, after fees, with lower volatility, while also better protecting clients’ capital when markets fall*.

The Quoted Managed Fund is a separate class of units in the unlisted Concentrated Australian Share Fund, a Morningstar Gold-rated, high conviction fund that invests in a select group of 20-30 high-quality, undervalued companies listed on the ASX. It has been managed by Hugh Giddy since the fund’s launch in 2010. Hugh has worked in financial markets since the 1990s, honing his craft with some well-known investors including Allan Gray, Anton Tagliaferro and Kerr Neilson. He is supported by a team of 10 portfolio managers and analysts who undertake rigorous fundamental analysis on every stock in the fund.

IML Chief Executive Damon Hambly says the listing is due to client demand:

“We continue to hear from our clients that they want choice. Choice not only in the assets they invest in, but also the way they invest. We are offering the Concentrated Fund as an active ETF to suit our financial adviser clients that like to invest this way, as well as retail investors who manage their own portfolios.

As passive investing continues to rise in popularity we are seeing an increasing demand for funds like the Concentrated Fund that offer something significantly different to passive index investing.”

Hugh says he enjoys the constraint and rigour required in choosing a concentrated portfolio:

“Due to the small number of stocks in the fund I select from among the highest quality companies on the ASX, and those I can buy at a reasonable price. The quality of the stocks has meant the fund tends to drop less than the benchmark in tough times, only falling half as much as the benchmark on average*. Low drawdowns have contributed to the fund outperforming over the long term, despite the fund sometimes lagging more frothy markets. Because the fund performs quite differently to the benchmark, it offers diversification benefits for investors while still investing in Australian equities.”

Read more about the IML Concentrated Australian Share Fund and the Quoted Managed Fund.

*IML Concentrated Australian Share Fund – performance vs benchmark since inception

Source: IML, Morningstar Direct, September 1, 2010 to end June 2023

Past performance is no guarantee of future results.

Concentrated Australian Share Fund performance is the performance of the unlisted class of units and may be a useful reference point for the newer quoted class of units in the Fund. However, you should be aware that the quoted class of units in the Fund has limited performance history. The past performance for the unlisted class of units in the Concentrated Australian Share Fund is NOT the past performance of the Quoted Managed Fund.

There is no guarantee that the investment objective will be realised or that the Fund will generate positive or excess return.

This information has been prepared by Investors Mutual Limited (IML) ABN 14 078 030 752, AFSL 229988. While the information contained in this report has been prepared with all reasonable care, IML accepts no responsibility or liability for any errors or omissions or misstatements however caused. This is general securities information only and is not intended to constitute a securities recommendation. This information does not account for your investment objectives, particular needs or financial situation. Past performance is not a reliable indicator of future performance. IML, is the responsible entity for all IML Funds, the Loomis Sayles Global Equity Fund (the investment manager is Loomis, Sayles & Company, L.P) and the Vaughan Nelson Global Equity SMID Fund (the investment manager is Vaughan Nelson Investment Management L.P). The relevant product disclosure statement should be considered before deciding whether to acquire or hold units in the Fund. Applications can only be made by reference to the current Product Disclosure Statement or through IDPS products that include these Funds. Potential investors should consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) before deciding whether to invest, or continue to invest, in the Fund. The PDS and TMD for the IML Funds can be obtained by contacting IML or at stg-imlimited-staging.kinsta.cloud.The PDS and TMD for the Loomis Sayles Global Equity Fund and the Vaughan Nelson Global Equity SMID Fund can be obtained at www.loomissayles.com.au and https://vaughannelson.com.au respectively.

© 2022 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘class service’ have been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. Refer to our Financial Services Guide (FSG) for more information at //www.morningstar.com.au/s/fsg.pdf. You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.