By Daniel Moore

READ

Australia’s Healthcare sector has outperformed all others over the last five years, due to strong demand from investors seeking companies with reliable earnings growth.

This has pushed valuations to historically high levels, with some healthcare companies trading at a 50 per cent premium to their global peers, and a 100 per cent premium to the broader Australian market.

In such a specialist industry with rich valuations, how then do you determine the best long-term investments?

In part one, of this two-part series on Australia’s Healthcare sector, Daniel Moore, Senior Equities Analyst and Portfolio Manager at Investors Mutual, outlines the key drivers of the sector’s performance, what he takes into account when investing in healthcare companies, and what he believes to be the best long-term opportunities for investors.

In Part 2 of this interview, Daniel discusses those healthcare stocks that he believes are the best investment opportunities, those that he doesn’t own, and what the future holds for the sector as a whole.

Great to speak with you, Daniel….what’s your background and how did you come to be a specialist in the Healthcare sector?

I’ve been hooked on investing since I was 15, after entering a stock market competition at school.

After studying Accounting and Finance at University, I spent a couple of years working as an accountant, before landing my first funds management role at BT Investment Management. That was 12 years ago and I was allocated the Healthcare sector by chance. Since then I have specialised on this sector of the market.

I joined IML as an analyst in 2010 and my areas of research have been the Healthcare and Supermarket sectors – I also manage a portion of our Australian Share Fund.

The Healthcare sector is incredibly diverse, and Australia has many companies that are global leaders, which makes analysing the sector particularly interesting.

As part of my research, I’ve watched cochlear implant surgeries, visited many different healthcare companies’ operations all over the world, such as pathology labs and plasma infusion clinics, as well as a visit to a surgical glove manufacturing plant in Malaysia – one that I always remember, as it was 45 degrees centigrade that day!

What does an investor get access to when investing in the Healthcare sector?

An investment in Healthcare offers real diversity that you don’t often find in most other sectors. You’re able to invest in companies that manufacture sleep apnoea devices or develop cochlear implants or create new plasma products – or companies that run hospitals or pathology laboratories.

Healthcare companies tend to be closely linked to healthcare spending by governments and private health insurers, with innovation and an ageing population being the two main drivers of performance.

For that reason, I’d consider the Healthcare sector to be a growth sector. However, the ability of governments and private health insurers to pay higher and higher healthcare costs is now becoming an issue for the sector’s future growth outlook.

You mentioned government and health insurer spending– how important is this to the performance of the sector, and individual companies?

Health care funding by governments and private health insurers is roughly split 70:30, with the government able to make changes to its spending far more easily than private health insurers.

With private health premiums in Australia rising around five per cent each year, people are starting to choose to downgrade their insurance cover to help manage their household budgets. This means that insurers are beginning to come under pressure, which in the future could flow on to the underlying healthcare suppliers being offered less by the insurers during regular price negotiations.

At the company level, the importance of government or health insurer funding really depends on how reliant a company is on these to generate revenues. Some companies are 100 per cent reliant on government funding (i.e. Medicare), which means that any changes to government funding has a direct and often significant impact on their operations. The GP sector, for instance, has had a tough period recently after the Government froze Medicare payments back in 2013. Fortunately for GP operators, this measure has recently been reversed.

From an investment perspective, the good news is that many Australian healthcare companies are global leaders in niche areas, with strong track records of innovation. This means that what happens in overseas jurisdictions has a much greater impact on their performance than changes to domestic healthcare funding.

Given the rising costs of health care, how do you see the reallocation of funding taking place?

Health care costs are growing at very high rates – around 5-6 per cent each year – with the government tending to reduce spending in those areas that rise the strongest, in order to keep costs under control.

However, at the same time the Government must fund new drugs, new tests and new medical devices that come onto the market, which often means that cost cutting in other areas is required to fund these too.

This process highlights just how important it is for companies to continue to innovate, through either developing new products and services, or finding more effective ways of producing existing products.

If they don’t, the price of their products or services can fall very quickly, or even become obsolete.

In your opinion, what makes a quality healthcare company?

As with other sectors, quality healthcare companies tend to have a strong competitive advantage, and are usually number one or two in their industry. Having the largest scale means they generally have the lowest costs (like Sonic Healthcare in pathology), or have intellectual property protection that ensures they can produce far more advanced products than their competitors (such as CSL or Cochlear).

The great thing about the Healthcare sector is the ongoing demand, which also allows quality companies to generate recurring, predictable earnings. This is important, as it helps a company budget its capital spending and growth ambitions. As an analyst, this predictability helps me to value these companies with a degree of confidence, as I can estimate reasonably well what these companies should earn over the next 3-5years. Having a diverse revenue stream is also important, with quality healthcare companies tending not to rely on just one test or single drug or one geographic market.

Capable management is also a crucial factor in such a fast changing industry, as it is the management team which sets the direction that the company takes. We spend a great deal of time meeting management teams (at least four times a year) to analyse their decisions. We find that the best management teams within the Healthcare sector are good operational, day-to-day managers of their business, as well as disciplined allocators of capital. It’s also critical that they are honest, and make decisions that are in the best long-term interests of shareholders, as opposed to being more concerned about making decisions to inflate short-term profits or the share price.

CSL is an excellent example of a quality healthcare company that’s been fortunate to have had two outstanding CEOs since it was floated 23 years ago. Both have driven fantastic operational results, growing profits and market share year after year, while performing several share buybacks and a few selective but very well-timed acquisitions.

How important is the background and experience of a Healthcare company’s CEO and management?

Given it’s such a specialist sector, we like to see management teams with a long-term background in their field.

Within the Healthcare sector, there’s also a great deal of careful planning involved in rolling out new products and services, a process that can often take up to 7-10 years.

That’s why it’s important to have prudent management with the experience to predict demand and allocate capital correctly, as it can be very expensive if you get it wrong.

What are some of the risks that investors should consider when looking to invest in healthcare companies?

One of the key risks for the healthcare sector is the ability of funders (government and private health insurers) to pay the ever-rising costs of healthcare services. The pressure that healthcare spending is putting on governments is leading them to look for cost savings wherever they can, a process that has seen prices for certain healthcare products and services fall.

Within the Healthcare sector, innovation is both an opportunity and a threat, and a company’s products or services can quickly become redundant if competitors develop better products and services.

So, investors should be cautious about investing in healthcare companies that are:

- highly reliant on government funding (e.g. Medicare payments) or

- have low research and development spend relative to their competitors.

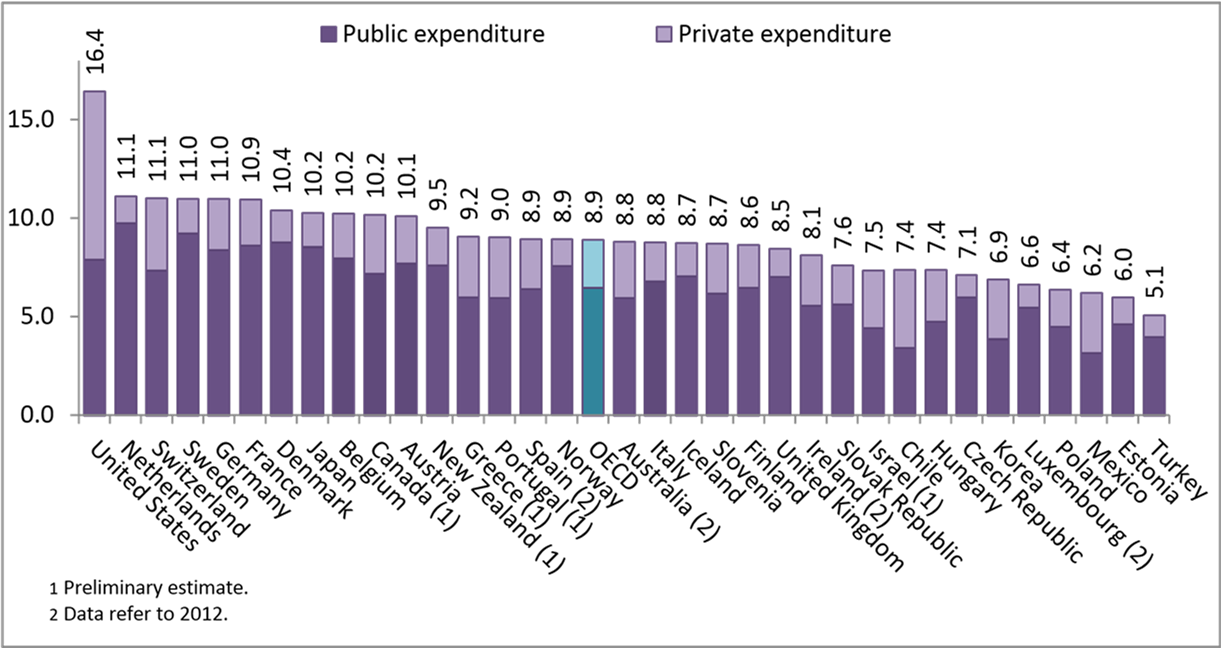

Chart 1: Healthcare spending (excluding investment) as a share of GDP, OECD countries 2014

Source: OECD Healthcare statistics 2014

And finally, what are some of most exciting new developments that you’re seeing at the moment?

Innovation within the Healthcare sector never stops, and we continue to be amazed at some of the new developments across a range of areas.

Within radiology, for example, artificial intelligence is now being developed that can read x-rays to identify cancers quickly and efficiently. What’s more incredible is that, as 1000s of X-rays are run through the computer, the program is able to learn from its mistakes and improve its accuracy.

There are also new drugs being developed around gene therapy, where a patient potentially only needs a couple of injections to treat disorders such as haemophilia, while within the pathology sector, new genetic testing may offer the potential for higher risk diseases to be identified and treated much earlier.

Even within the surgical area, doctors are now looking at less intrusive ways of operating on people through the use of robots.

This is why I enjoy analysing the Healthcare sector so much – it’s constantly evolving, which provides plenty of opportunities as well as challenges.

Read part two as Daniel discusses IML’s top healthcare picks.

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (AFSL 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.