By Marc Whittaker

READ

In the wake of the recent Australian reporting season, three Australian small-cap stocks across three very different sectors stand out for the strong long-term growth prospects they offer investors, while also trading at attractive valuations. These are Cuscal, Aussie Broadband and MaxiPARTS, each of which is enjoying growing market share in their respective industries.

Cuscal: Leveraging the surge in digital payments

Cuscal recently listed on the Australian share market and has enjoyed strong growth in its share price since November 2024. The company is the largest provider of digital payments infrastructure to organisations outside of Australia’s big four banks. Cuscal has a strong growth runway ahead, driven by market share gains and a strong tailwind from increasing digital payment adoption.

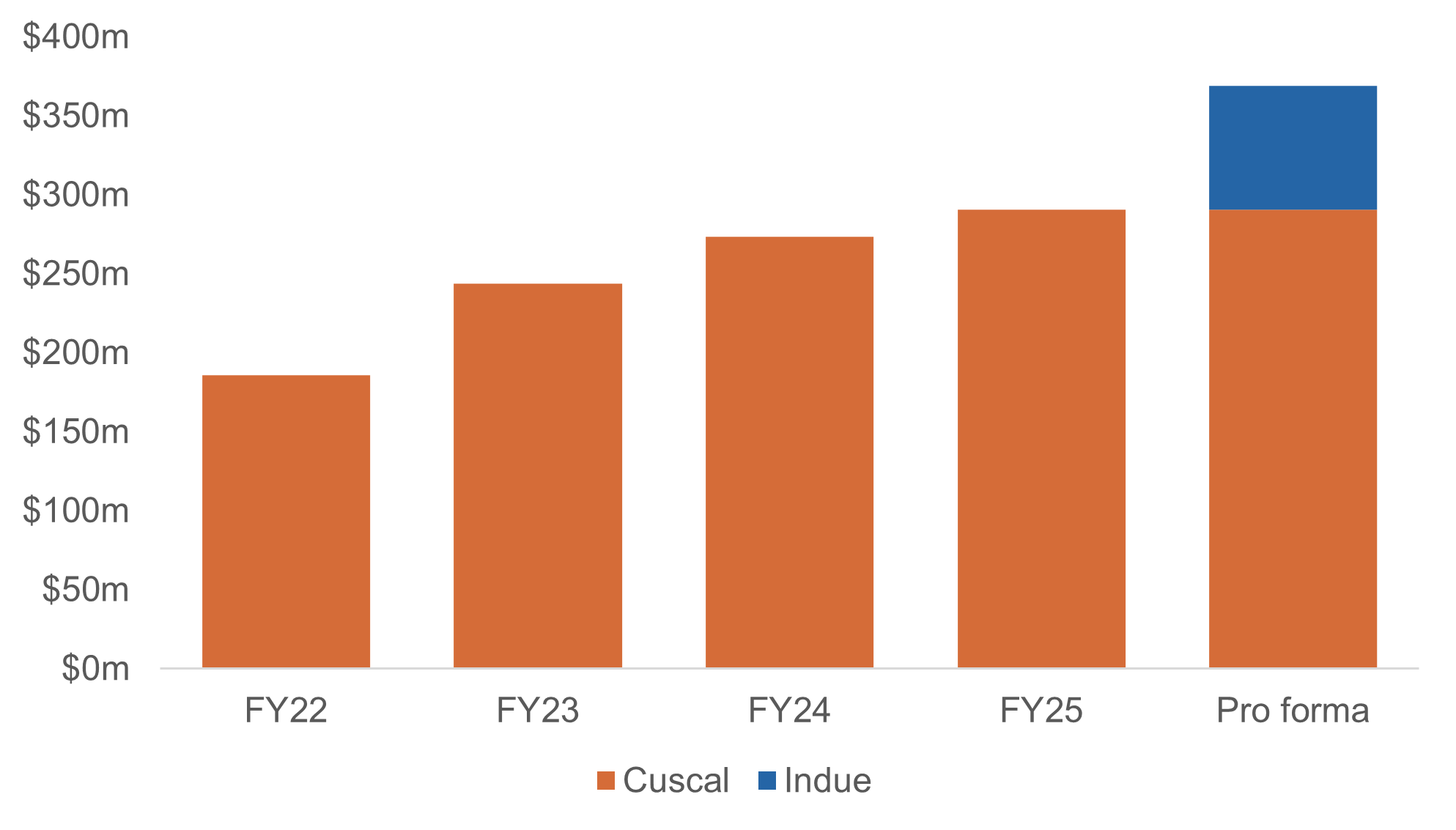

Cuscal’s recent acquisition of its number two competitor in the non-major bank payment processing space, Indue, will provide Cuscal with additional scale to drive accelerated earnings growth. Once Cuscal transfers Indue’s customers onto its platform, the acquisition is expected to add +35% to its earnings.

Chart: Cuscal Net Operating Income

Source: Cuscal company presentation, August 2025

Cuscal’s valuation remains attractive following its recent strong share price performance. The stock is trading at 15 times earnings from the existing Cuscal business (ie excluding Indue), which is very reasonable for the defensive cashflows it generates from growing digital payment volumes. This multiple drops to just 10 times once accretion from the Indue acquisition is included. With Cuscal’s earnings growth projected at over 20% per annum compounded over the next four years, Cuscal is a reasonably valued, high-quality, infrastructure-like business with predictable growing earnings.

Aussie Broadband: Resilient earnings with growth potential

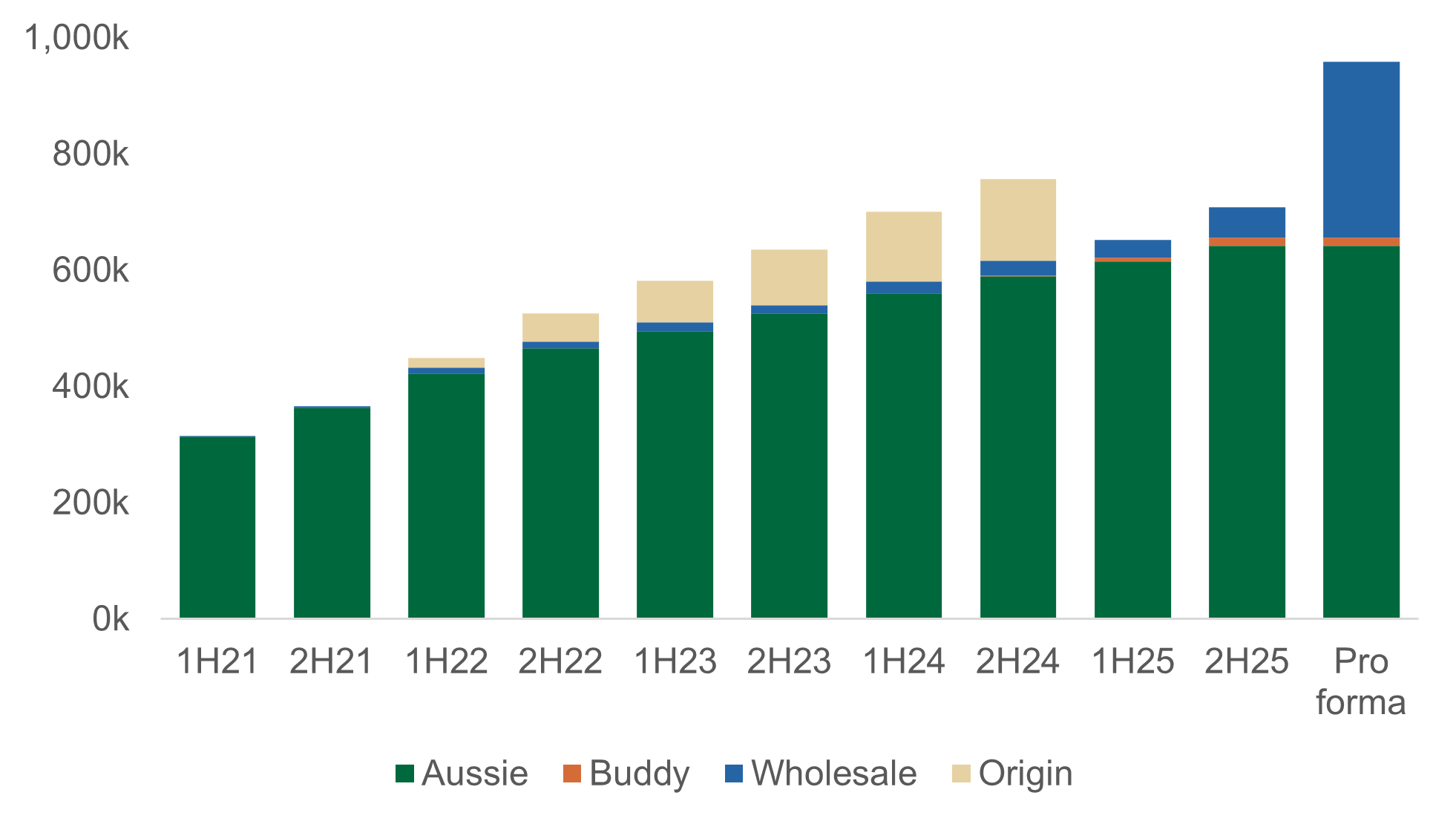

Aussie Broadband offers a rare combination of resilient, defensive earnings, strong growth, and a reasonable valuation. The company delivered a standout result in the August 2025 reporting season, posting its highest subscriber growth in three years. Revenue for FY 2025 jumped +19% to $1.19bn while on-net broadband connections rose 104,100 to 788,400, representing +15.2% growth.

Chart: Aussie Broadband residential broadband connections

Source: Aussie Broadband company presentation, August 2025

The company is likely to reap accelerating revenue and customer growth as it gains customers in the residential and business broadband markets. Aussie Broadband’s market share rose 1.1 percentage points to 8.4% in FY2025, making it the fifth largest telecommunications company in Australia. We expect it will make continued inroads due to its superior service proposition relative to large incumbents such as Telstra.

We like the company’s valuation too. Aussie Broadband is trading on 19 times its fiscal 2027 earnings per share. That compares favourably to its closest listed peer Superloop (on c40 times fiscal 2027) and other ASX-listed growth stocks with recurring earnings like software-as-a-service companies .

The company posted positive earnings results in August, with underlying Net Profit After Tax and Amortisation rising +6.5% to $55.8m despite the headwind of Origin moving its large wholesale customer base to Superloop. Aussie Broadband reported several notable Enterprise & Government (E&G) customer wins and 183 new Wholesale partnerships; a strong pipeline of opportunities underpins further growth.

Aussie Broadband also announced a significant wholesale subscriber agreement with More Telecom (Tangerine), a broadband reseller backed by the Commonwealth Bank. This deal involves Tangerine transitioning its customer base from Vocus to Aussie Broadband and includes the company buying Tangerine’s challenger brand, Buddy. This deal is expected to push Aussie Broadband’s subscribers well over a million, strengthening its NBN market share. IML projects that this wholesale deal will help drive +25% compound earnings per share growth over the next two years. This will add to the company’s appeal as a strong investment opportunity.

MaxiPARTS: Driving towards long-term success

MaxiPARTS focuses on supplying automotive parts, predominantly for trucks, trailers, and commercial vehicles, including heavy trucks and small delivery vans. There are several growth drivers for the company, including recent acquisitions, an ageing and growing heavy vehicle fleet and an increasing trend towards aftermarket parts due to superior service and lower prices than Original Equipment Manufacturer (OEM) parts.

Key recent acquisitions for MaxiPARTS include the purchase of Truck Zone in 2022, providing exposure to Japanese truck and trailer parts, Independent Parts in 2023, which established a presence for the company in Western Australia and to the all-important mining sector. MaxiPARTS also acquired 100% of Förch Australia across two transactions in 2023, which operates in a high-growth market in workshop consumables that leverages MaxiPARTS’s existing customer base and product range.

The transition to electric vehicles (EVs) also presents an opportunity for MaxiPARTS. While EVs have fewer engine parts, they still require maintenance for axles, wheels, and tyres. Furthermore, the acquisition of Förch, which focuses on automotive tooling and consumables for workshops, positions MaxiPARTS well to cater to the maintenance of commercial EV fleets.

MaxiPARTS enjoys a very strong balance sheet, providing opportunities for future acquisitions to further expand its offerings and footprint through industry roll-ups. Revenue grew +9.5% to $267m in FY25, and earnings per share from continued operations was 15.4 cents, up +43.9% versus FY24. The company expects to deliver continued growth in Earnings Before Interest, Taxes, Depreciation, and Amortisation margins into low double digits in the medium term.

The strong share price performance demonstrated by all three companies in response to recent earnings results was well justified given their quality and value at the smaller end of the market, where companies are often less well understood and poorly researched. We continue to find plenty of opportunities to deploy capital into undervalued small and mid-sized companies, despite the broader Australian share market trading just below all-time highs.

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited ABN 60 088 786 289 AFSL 246830 and includes information provided by third parties, including Investors Mutual Limited (“IML”) AFSL 229988. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third party, except for liability under statute which cannot be excluded. The material is for general information only and does not take into account your personal objectives, financial situation or needs. You should consider, and consult with your professional adviser, whether the information is suitable for your circumstances. Past investment performance is not a reliable indicator of future investment performance and that no guarantee of performance, the return of capital or a particular rate of return is provided. You should consider the information contained in the Product Disclosure Statement in conjunction with the Target Market Determination, available at www.iml.com.au. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML. Statements of opinion are those of IML unless otherwise attributed. Except where specifically attributed to another source, all figures are based on IML research and analysis. Any investment metrics such as prospective P/E ratios and earnings forecasts referred to in this presentation constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold that stock. Any commentary about specific securities is within the context of the investment strategy for the given portfolio.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.