By Marc Whittaker and Lucas Goode

READ

There was a lot of talk about the return of small caps in 2025. And yes, Australian small caps did perform well in 2025, up 25% for the year, outperforming large caps by around 16%i. On the surface it might appear that because of this period of outperformance, small caps are set for a period of more muted performance, or even a pull back. While of course this is possible, we think that if investors focus on small cap opportunities in industrial stocks, small caps remain well placed for superior growth in 2026 relative to large caps.

Select small caps well set to outperform in 2026

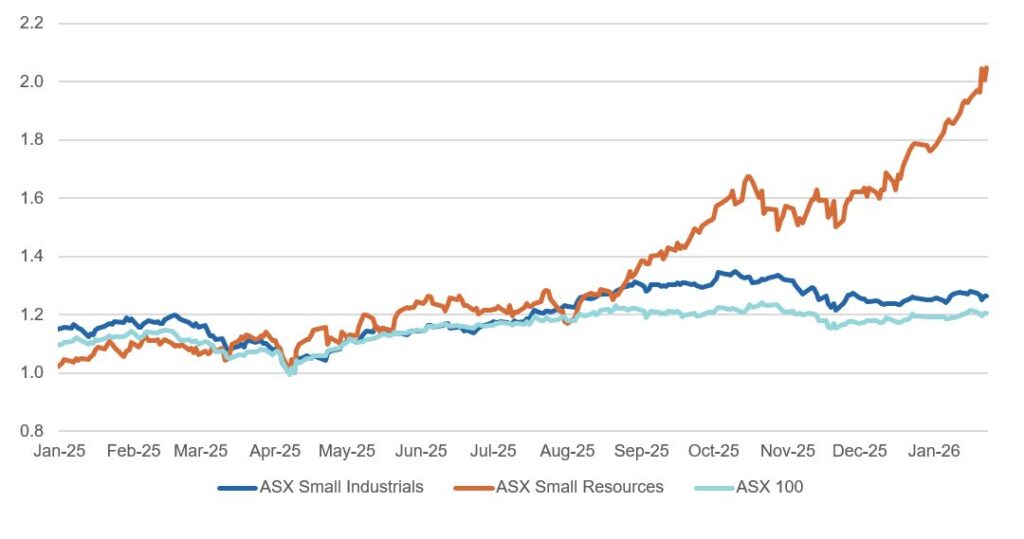

While small caps did well overall in 2025, this growth was not uniform. Most of the small cap outperformance was driven by small resources as you can see in the chart below, particularly gold stocks. Whereas small industrials, which are typically higher quality and where most of our holdings lie, only just beat large industrials for the year.

Source: FactSet; As at 23 January 2026

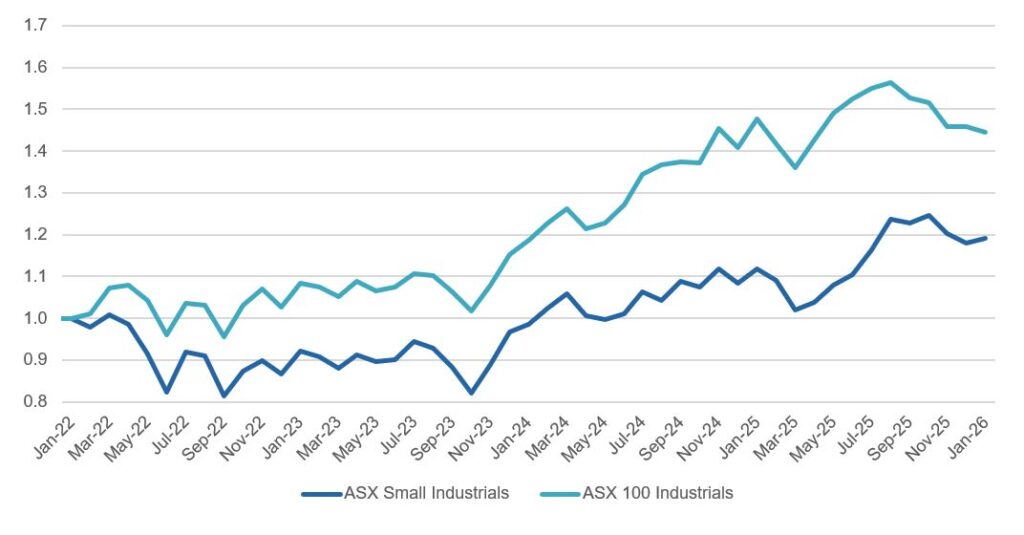

If we take a longer-term view, we can see that small cap industrials have only slightly closed the performance gap with large cap industrials that started widening in early 2022.

Source: FactSet; As at 23 January 2026

At an aggregate level, small industrials are trading at a c10% price-to-earnings discount to large industrials, despite offering twice the earnings growth according to consensus forecastsii.

With valuations looking stretched in some parts of the market, one of the advantages small caps have is a more diverse investable universe. For investors concerned about exposure to record high bank valuations in a declining return on equity environment, or about resources exposure when China’s export-led growth model is being increasingly challenged – well within large caps there are fewer options available. For small cap investors, that’s not a problem.

Within small caps, there remain a number of high-quality stocks with large runways of growth ahead of them which are still trading at very attractive valuations.

Our top 3 high quality, reasonably priced small caps for 2026 and beyond

Australian Clinical Labs (ACL) – ready for a rebound

ACL is the third-largest pathology provider in Australia, behind Sonic and Healius. We see ACL as a clear standout in terms of valuation, while the company is also best-in-class in terms of operational efficiencies with the investments it has made in its national laboratory platform and its technology stack.

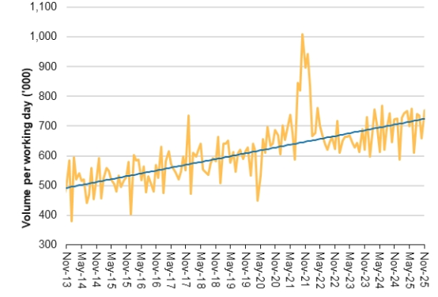

We like healthcare as a sector, which is growing overall due to population growth and ageing demographics in Australia. Older people tend to have more complex medical issues and see their doctors more, and so are referred for tests more often. The move toward preventative medicine and earlier intervention, partly to decrease healthcare costs overall, also increases the incidence of diagnostic testing. This can be quite clearly seen in the steady growth in Medicare funded pathology over the last decade.

Volume per workday – base pathology

Source: Medicare data, Macquarie Research, January 2026

Healthcare was the worst performing sector last year in Australia, down -13% in the Small Ordinaries index and -24% in the ASX 300iii. We think that the market has become overly fixated on short-term pressures on operating margins for some of the local operators, as revenue growth tied to Medicare indexation lags growth in labour and other expenses. In this scenario, companies like ACL have been marked down excessively.

The result of that though is that investors can buy ACL at a price to earnings ratio of 14 timesiv, with a strong balance sheet and capable management. ACL should be able to grow revenue at 5-7% and continue to grow margins over time as it takes advantage of greater scale and technology to build out greater efficiencies.

We think there is a good chance that healthcare will rebound this year, as we have seen following previous drawdowns, and if that happens ACL is well placed to benefit.

Collins Foods (CKF) – fast food, primed to go faster

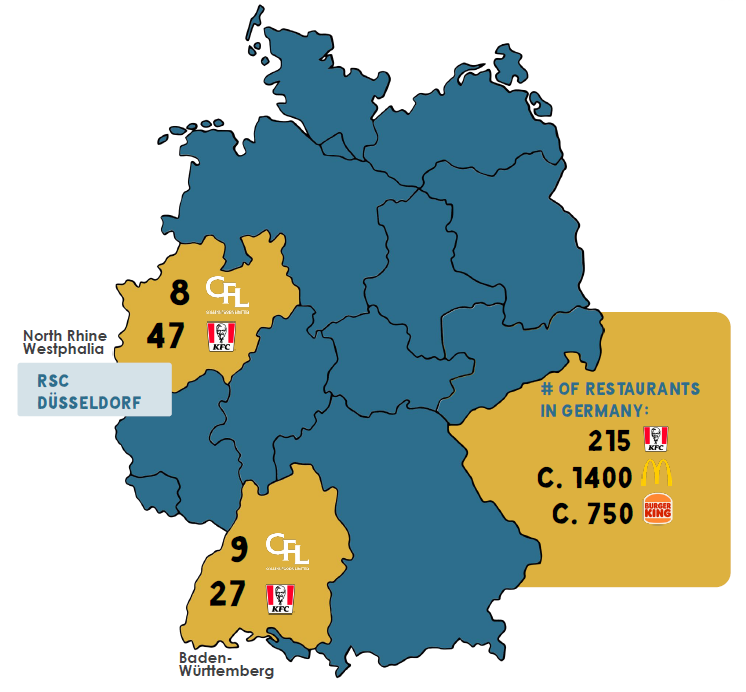

Collins Food is the largest owner and operator of KFC restaurants in the country. One in every three KFCs in Australia is owned and operated by Collins Foods – mostly in Queensland, with some in Western Australia and Tasmania. They also have the franchisee rights to the KFC brand in the Netherlands and several German regions. There are two main reasons we like CKF and think its prospects look strong this year – growth and brand.

Firstly, growth: CKF reported like-for-like sales growth of +3.5% in the first half of FY26, higher than that of its competitors. Along with that growth, CKF has been expanding its margins in both Australia and Europe through operational efficiencies and new digital initiatives that have been introduced into the business. The company also has a solid plan for further growth, with a target of 100 new stores in the next five years, split evenly between Australia and Europe. There is significant opportunity in Germany in particular, where the brand resonates well but the physical store footprint is significantly underpenetrated. Yum!, the global owner of the KFC brand, has recently awarded Collins franchisee rights in two additional, key growth German territories, which represents a great opportunity.

Source : CKF investor day presentation, October 2025

Secondly, brand: the KFC brand is very strong in Australia, with a long history of effective marketing and brand awareness. The brand has a strong association with value, which continues with innovations in its product offering and also its pricing. In these budget conscious times, KFC represents considerable value compared to competitors like McDonalds. This value association makes it very resilient through the economic cycle and it continues to do well in a time when cost of living has been front of mind for many people. The new CEO, Xavier Simonet, has been in place for just over a year and is making logical, well considered decisions on how best to grow the company and shareholder value.

With Australian consumers feeling a bit more confident but still focused on value, fast food restaurants tend to do well in this kind of environment. Given it is trading at a good price, around 16 times earnings heading into 2027v, we think Collins Foods looks well placed this year to continue to perform well.

SkyCity (SKC): play an NZ economic recovery

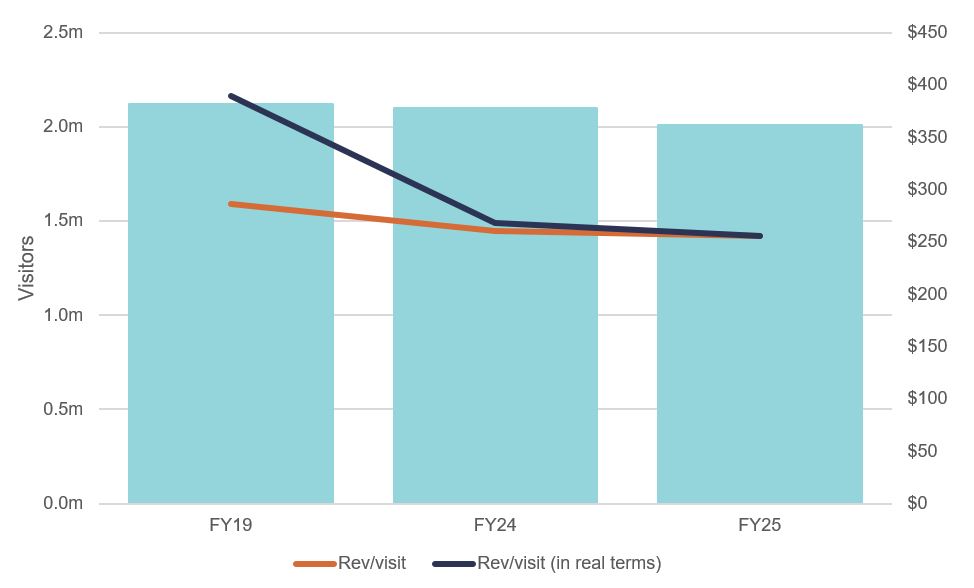

Casino operator SkyCity Entertainment has had a torrid few years with a recession in New Zealand, regulatory pressure on both sides of the Tasman and a stretched balance sheet (leading to a deeply discounted equity raise) resulting in material share price underperformance. While the introduction of mandatory carded play is a headwind, visitation has actually remained relatively stable at the core Auckland casino as shown below. Unfortunately, the weak NZ economy has resulted in spend per visit falling 35% in real terms since FY19.

SKC Auckland visitation and spend per visit

Source: SKC FY19 and FY25 results presentations

While the economic environment remains challenging in New Zealand, lead indicators such as increased border crossings (an indicator of improved tourism) and growing household spending suggest that a recovery is underway following a number of interest rate cuts. SKC’s Auckland entertainment precinct is a clear beneficiary from both higher international arrivals and increased domestic consumer spending. With earnings in Auckland 30% below their pre-covid peak in FY25 and the addition of the recently opened New Zealand International Convention Centre, a large rebound in earnings is possible.

In addition to improved consumer spending and the completion of the NZ International Convention Centre driving higher earnings from the NZ gaming assets, flagged asset disposals are a further catalyst. Both the Adelaide hotel and Auckland car parking concession are highly saleable assets and disposals at or near book value would highlight the significant implied discount being applied to the core group assets. SKC is trading at just 0.7x book valuevi, as well as providing the balance sheet flexibility for a share buyback.

i. Source : Factset, as of 31 December 20225

ii. Source: Factset, IML estimates

iii. Source: IML, as of 31 December 2025

iv. IML estimates, as of 31 December 2025

v. IML estimates, as of 31 December 202

vi. IML estimate, as of 31 December 2025

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited ABN 60 088 786 289 AFSL 246830 and includes information provided by third parties, including Investors Mutual Limited (“IML”) AFSL 229988. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third party, except for liability under statute which cannot be excluded. The material is for general information only and does not take into account your personal objectives, financial situation or needs. You should consider, and consult with your professional adviser, whether the information is suitable for your circumstances. Past investment performance is not a reliable indicator of future investment performance and that no guarantee of performance, the return of capital or a particular rate of return is provided. You should consider the information contained in the Product Disclosure Statement in conjunction with the Target Market Determination, available at www.iml.com.au. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML. Statements of opinion are those of IML unless otherwise attributed. Except where specifically attributed to another source, all figures are based on IML research and analysis. Any investment metrics such as prospective P/E ratios and earnings forecasts referred to in this presentation constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold that stock. Any commentary about specific securities is within the context of the investment strategy for the given portfolio.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.