By Lucas Goode

READ

We’ve been Telstra shareholders for a long time. It’s exactly the type of company we like: a market leader, with strong competitive advantage, recurring earnings, solid dividends, capable management and resilient in tough economic times.

But while in general we look favourably on Telstra, that doesn’t mean we always think it’s a good buy. Over the years the size of our investment in Telstra has gone up and down depending on a number of factors including the industry’s competitive dynamics, the regulatory outlook and value.

Right now, we think Telstra is well positioned for future long-term success.

It’s the dominant player in an industry that is improving and becoming more rational. It’s also in a strong position to cope with high inflation and rising interest rates and has recently started growing its dividend again.

In this article we look at the investment case for Telstra in greater depth, including the factors mentioned above.

Are Telstra shares good value?

We think Telstra shares are reasonable value right now.

As you can see in the chart below IML’s active weight in Telstra (the percentage of Telstra shares we hold compared to the market) has fluctuated over the years.

Source: IML & FactSet, as at 28 February 2023

We built up a significant position in the company between 2009 and 2011 as Telstra’s shares wallowed at or below $2.80. The company was embroiled in a dispute with the Federal Government over the NBN rollout at the time and this hurt its earnings and share price.

After the dispute was resolved, Telstra entered a multi-year period where it grew its mobile earnings strongly each year. There were two main reasons for this:

- The 4G rollout from 2011. The move from 3G to 4G was a massive change for the mobile industry as it allowed high-definition video to be streamed on mobile phones for the first time. Telstra was already well known for having the best network coverage and it rolled out 4G more efficiently than its rivals, leading to it gaining customers from other networks that wanted the best 4G experience on the newly released phones of the time.

- Vodafone, one of the other two mobile network operators (along with Optus), had significant network issues which led to its customers’ often losing signal and dropping out of phone conversations or losing internet connection. This led to it being dubbed ‘Vodafail’ and losing a lot of customers.

These factors, as well as a generally benign industry environment, allowed Telstra to strongly increase its mobile service revenue over the period through a combination of market share gains and stable average revenue per user (ARPU), leading to a significant increase in both profits and margins. Telstra’s share price rallied from 2011-2015 to eventually peak at over $6.

During that period, we reduced our exposure to Telstra significantly because, in our view, the shares appeared fully valued. We thought that many investors took too optimistic a view of the company’s prospects and we also saw that the NBN was likely to impact Telstra’s earnings from its fixed-line business.

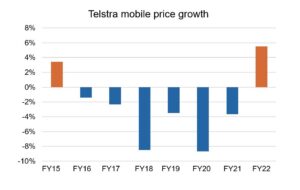

In the years from 2016 – 2019 Australia’s mobile industry was involved in a mutually destructive price war, triggered by new management at Optus. Optus aggressively cut its mobile pricing in an attempt to win market share and Telstra followed Optus down in pricing, to protect its market position. This saw Telstra’s earnings and dividends fall, along with its share price. With the share price falling below $4 we saw greater value emerge, despite the negative news, so started to slowly rebuild our holding in Telstra in 2017 and more aggressively in late 2018 after the announcement of the merger between TPG and Vodafone. During this period the dividend declined from 31c to 16c which was below our expectations at the time.

Following the merger between Vodafone and TPG, and a change of management at Optus, Australia’s telecommunications industry has become more rational and increasingly attractive to investors like us. We continued to increase our holding in Telstra during the share price weakness through Covid and have benefitted from the appreciation in its share price. Since 2021 the main parties have acted more rationally, increasing their pricing to pursue greater profit and returns for shareholders.

Telstra is the number one player in an attractive industry

Telstra dominates Australia’s telecommunications industry and has held this position for many years. It has a strong brand, the best network coverage in Australia, which allows it to charge a premium over its competitors, and therefore has the best margins in the industry.

With the industry more rational today, and the price wars from 2016-2019 over, mobile prices are starting to rise once again.

Source: Telstra presentations, postpaid handheld growth by average revenue per user (ARPU)

As the industry leader in mobile, Telstra will take the lion’s share of this increase. Telstra’s management also has a good handle on its costs. In its update in February 2023 Telstra showed an impressive ability to keep costs in check, despite high inflation – in our view this increases the likelihood it can grow revenue faster than inflation and so increase profits.

During the Covid years, mobile subscriptions dropped for the first time ever. Now that Covid is (thankfully) mostly in the rear-view mirror, mobile subscriptions are rising again as Australia’s immigration, student and tourism numbers are all heading back to pre-Covid (normal) levels. This constant flow of new arrivals should see around 300-400,000 new mobile subscribers added every year, benefitting all players.

In addition to improvements to its operating business, Telstra has begun to successfully monetise its infrastructure assets. It sold 49% of its towers business to a consortium led by the Future Fund in 2021 for $2.8 billion, which valued it at 28x Enterprise Value (EV) to EBITDA . We think this was a great price which showed how much large, institutional investors will pay for these kind of high-quality assets with recurring, predictable income. All of Telstra’s infrastructure assets are now structurally separated from Telstra into Infraco, including all of its NBN revenue. We think it’s likely that Telstra will ultimately sell all, or part, of Infraco at some point in future, noting that the company has already achieved a significant re-rating from the market on the back of this structural separation.

Telstra is well placed to succeed in a high inflation environment

Inflation is high, and while it may have peaked in late 2022 in Australia, higher than average inflation is likely to be here for some time. Telstra has many qualities in its favour in this environment.

- Defensive industry. When times are tight people might eat out less, buy fewer fancy couches and cut back on travel but they’re very unlikely to cut their phone or internet.

- Pricing power. As mentioned above Telstra has a very strong brand and dominant position in an increasingly rational industry, putting it in a strong position to raise prices.

- Stable cost base. Telstra is in a relatively fixed-cost industry, so when it increases revenue on that fixed cost base, the large majority of that increase drops through to the bottom line as profit. While Telstra is a large employer, only around 30% of its costs are direct staff costs, limiting exposure to wage inflation relative to more people-heavy businesses. Finally, as part of Telstra’s T25 transformation program, it has committed to removing $500m of costs by June 2025 which should more than offset any inflationary increases. Notably, despite the high inflation environment, Telstra reaffirmed its intention to hit its cost reduction targets in its half-year report in February 2023.

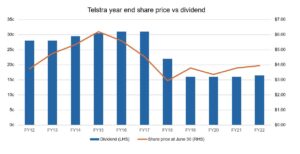

Dividends growing again

After several years of declining, Telstra’s dividends are back in growth again.

Source: IRESS, Telstra company data

Telstra has now fully absorbed the loss of its fixed-line revenues to the NBN and the ‘mobile price wars’ of 2016-19 are well and truly over. Telstra’s mobile business is now a significant part of its earnings and is growing steadily given the more rational industry. With industry returns still in the low single digits (1-2%), we see further price rises and profit growth in its mobile business in the years ahead. In addition, Telstra owns a number of infrastructure assets whose earnings are growing in line with inflation, supplementing the company’s earnings growth.

In February 2023 Telstra increased its interim dividend from 8 cents per share to 8.5 cents.

Get the biggest piece of a growing (and extremely defensive) pie

After years in the doldrums, Australia’s telecommunications industry is looking attractive to investors again. A destructive price war, the rollout of the NBN, and finally Covid, significantly impacted the industry’s returns. Now that the industry is rationalising and normalising, its fundamental attractiveness is re-emerging.

Telstra is the dominant player in this improving industry and we think it is well-placed to provide attractive returns to investors in years to come. In a high-inflation environment there aren’t many businesses where you would be confident about their ability to improve margins in future years. With Telstra’s innate advantages and strong management team, led by the excellent Vicky Brady, we think it’s well positioned to do just that.

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (IML) (AFSL No. 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is general in nature and does not constitute personal advice. This advice has been prepared without taking account of your personal objectives, financial situation or needs. Investors should be aware that past performance is not a reliable indicator of future performance. The fact that a particular security may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock. Any reference to a particular security is general in nature and should not be taken as an endorsement by IML. Any forecasts referred to in this article constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.