By Daniel Moore

READ

Investors have woken up in 2023 in a rather optimistic mood, with share markets rising dramatically around the world, particularly at the more cyclical and speculative end of the market. The ASX 200 is up 6% for January, one of its best Januaries ever, the Nasdaq is up 11% with some of the more speculative stocks going vertical. Tesla, for example, is up close to 60% in the past five weeks.

While of course the rally is welcome news for investors, it has left us wary rather than excited. We’re wary because the market rally seems to be backing central bankers to solve a multitude of major macro-economic issues with surgical precision – this seems unlikely given their recent form.

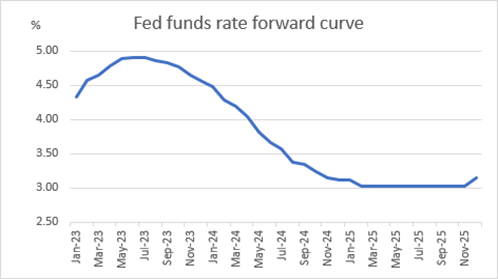

In summary, the equity and bond markets seem to be forecasting that:

- Inflation will continue to retreat from its highs back towards the Fed’s 2% target by 2024

- Central banks will cut interest rates ~1.5-2% over the next 18-24 months

- Company earnings will continue to grow unabated

US Bond yield curve – forecasting interest rates falling close to 2% through CY24

Source: Bloomberg, as at 31 January 2023

It’s a very neat scenario, but the question we ask ourselves, is it realistic?

More specifically, is it realistic that:

- Inflation will fall to the Fed’s 2% target without a recession, or fall in corporate earnings?

- Inflation will fall to 2% within 18 months, period?

We see significant risks to both scenarios:

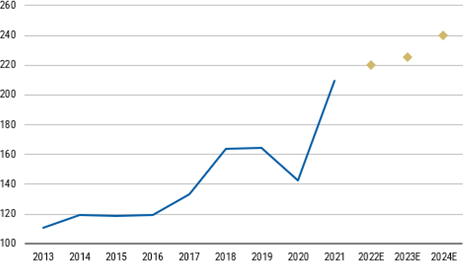

1. Corporate earnings forecasts could be too high

Right now, companies’ consensus earnings estimates look bullish in the US and Australia, where earnings per share are expected to grow off a stimulus-fuelled base line in CY21. As shown in the chart below, CY21 earnings were roughly 30% higher than their pre-Covid levels in CY19. CY21 was a boom year for many companies due to trillions of dollars of stimulus, low rates and the global economy reopening after the worst of Covid.

S&P 500 earnings per share (EPS) by calendar year

Source: Refinitiv, S&P, Morgan Stanley Research, Full year EPS is sum of 4 quarters, based on data available as of 1 January, 2023

Today, the picture couldn’t be more different. Interest rates are 3-4% higher, government and central bank stimulus has been drastically reduced and corporates are facing significantly higher inflation. We are not expecting consensus forecasts to be far off the mark for CY22, but CY23 & CY24 could be tough relative to the optimistic consensus forecasts above. Along with the direct headwinds of higher interest costs, companies will also have to deal with the delayed impacts of rising rates, particularly from reduced consumer spending.

This is a particular issue in Australia, where (as we wrote about earlier) a large number of fixed rate mortgages are expiring. Roughly 50% of all fixed-rate mortgages in Australia expire in CY23 and mortgage rates for this cohort will lift from around 2% to 5.5-6.0% during the year. This will have a material impact on disposable income for these households with flow-on effects to company earnings.

2. Inflation could prove sticky and stubborn

Inflation is like that late-night dinner guest that just won’t leave, no matter how many times you yawn or look at your watch. In the 1970s it took a decade for Australia to eradicate high inflation and while we’ve presumably learned lessons from that period, many other countries have struggled to stamp out high inflation since then.

There are certainly some positive signs that inflation is coming down – for example a dramatic improvement in supply chains, and a fall in many raw material costs – however inflation remains high and there are several lag inflation impacts yet to be felt:

- Many companies will negotiate Enterprise Bargaining Agreements with their staff over the next 12-24 months. With inflation so high workers will be demanding wage increases well above the normal 2-3% p.a., and with unemployment so low employers will be in a tough bargaining position.

- Many companies have old, fixed price contracts with suppliers which will expire throughout the year, leading to large cost increases on renewal. These higher costs will likely be passed on to customers through higher prices.

There are also several macro-economic factors playing out that could impact global inflation. China is re-opening and exactly how this will impact the global economy is a big unknown. The world’s second largest economy has been closed for nearly three years, and much will have changed during that time. If the reopening goes well an increased demand for raw materials could provide further inflationary pressure.

Another major recent trend which has pushed up inflation is deglobalisation. As Covid and the war in Ukraine snarled complex international supply chains, countries and companies have been moving critical parts of their supply chains into their own countries or to closer, friendlier, or more politically stable countries. This trend shows no sign of abating and increases the cost of goods, bringing a multi-year inflationary headwind. This is a very different equation to the multi-decade globalisation trend we experienced pre-Covid, which brought a deflationary tailwind for economies.

Market expectations for US CPI 1 year forward

Source: Bloomberg

Is it time to be optimistic or cautious?

The optimism infusing markets right now seems to be based on relatively uncertain assumptions. To achieve the Goldilocks scenario of a significant reduction in inflation and interest rates, with growing corporate earnings, requires the global economy to walk a very narrow path with many pitfalls on the way. The fact that markets think central bankers will be able to tread this narrow path given their recent dismal track record is somewhat ironic.

Investors need to ask themselves: is now the time to take on more risk?

We don’t think the risk/reward equation is favourable at the moment for risky stocks.

With the ASX just a whisker away from all-time highs, inflation at nearly 8%, interest rates over 3% and rising, and as central banks continue to remove liquidity from markets – there are a lot of reasons to remain cautious. At IML, we think the most likely path to above-average returns in the medium-long term is to invest in companies which are industry leaders, providing essential products and services with pricing power, strong balance sheets and experienced management teams. We prefer to back these sorts of businesses rather than backing central bankers to prepare the Goldilocks-style perfect bowl of porridge that cyclical and speculative companies require.

Important information

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (IML) (AFSL No. 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is general in nature and does not constitute personal advice. This advice has been prepared without taking account of your personal objectives, financial situation or needs. Investors should be aware that past performance is not a reliable indicator of future performance. The fact that a particular security may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock. Any reference to a particular security is general in nature and should not be taken as an endorsement by IML. Any forecasts referred to in this article constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.