By Daniel Moore

READ

When looking at all stocks over a period of time, even the best quality ones, it becomes clear that companies often fall into or out of favour with investors based on short-term factors. These short-term factors can greatly impact the perception and the PE rating of the company’s stock price and will often impact investors’ perception as to what constitutes a company with bright prospects (a ‘growth’ stock) as opposed to a company with poorer prospects.

Further to IML’s recent Investment Insights ‘Market dynamics – the case for value remains’, Daniel Moore, IML Portfolio Manager, compares two ASX top 100 stocks – A2 Milk (market cap $8 billion) which falls firmly into the ‘growth’ stock category and Brambles (market cap $14 billion), which is perceived by many in the market as having earnings issues and is thus seen as a much less exciting prospect, thereby now very much falling into the ‘value’ category.

A2 Milk is a New Zealand milk products company listed in Australia and the stock has been a star performer over the last few years as Chinese consumers that can afford it have swapped their buying preferences to overseas infant formula brands after melamine was found in infant formula of Chinese local brands in 2008. Thanks to this scare, demand for A2’s products have benefited greatly from its clean, green NZ image.

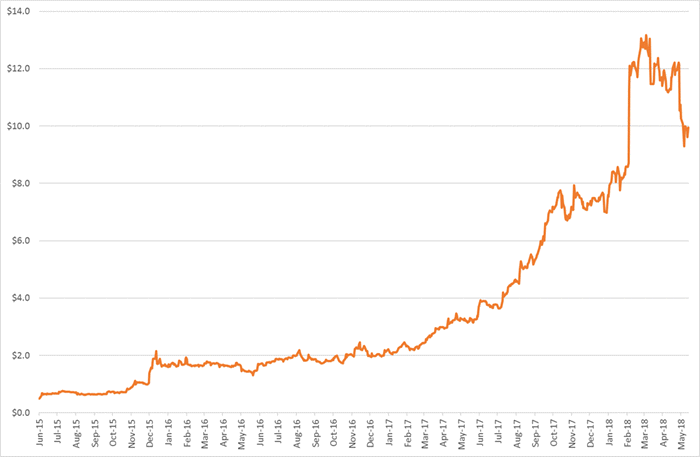

As a result of this, A2’s profits have risen rapidly from effectively zero a few years ago to a forecast NPAT of NZ$188 million in FY18 and its share price has risen from under $2 a share to over $10 a share (see chart 1 below) valuing the company at $8 billion – this valuation now equates to a not insignificant PE of 44 times the company’s FY18 forecast earnings.

Chart 1: A2 milk’s share price over the past 3 years

Source: IRESS Date: 18 June 15 – 18 June 18

A2’s recent past success is now obvious to all – the question is whether A2’s Milk shares on a PE of 44 times represent good buying today or is A2 too risky an investment for the prudent long-term investor?

There are many things to consider when answering this question. Crucial factors for investors to assess are how sustainable A2 Milk’s current EBIT margins of 30%, and its cash-adjusted return on equity of close to 100% will be going forward. In reality, it will only be possible for the company to continue to generate these exceptional returns going forward if the company’s product and competitive position are extremely strong.

The key questions then become: Is an investment in A2 shares still an attractive proposition given the high expectations implied in its lofty valuation? Has the company got a strong enough competitive advantage through its brands and products to enable A2 to continue to produce and grow its recent returns in the longer term?

One of the major issues for A2 is that its product has been successful in China through the unregulated and opaque so-called Chinese ‘daigou’ or suitcase market and not through any exclusive distribution agreement. The company has managed to achieve an estimated 5% share of the Tier 1 market in China through word of mouth and A2 has managed to achieve this share through limited marketing spend.

A2’s success is now drawing attention from many milk producers and competitors in the sector – recently global giant Nestle, with all its scale and marketing clout launched “Atwo” into China to directly compete in A2’s market. And only in the last fortnight, Bubs Australia announced it was increasing its milking herd by over 5-fold and raising capital to take advantage of the opportunities in the infant formula market in China.

While it is true that A2 has grown rapidly and has a cashed-up balance sheet, in our opinion, those investors who are extrapolating A2’s current margins and returns well into the future are likely to be disappointed. We believe that the market appears to be overly optimistic on A2’s outlook as the high returns the company currently enjoys are unlikely to be sustainable over the long term as competition increases, and on a PE of 44 times forecast earnings, A2 is a very risky an investment in our opinion.

This leads us to Brambles, a stock which we have been recently adding to in IML’s portfolios.

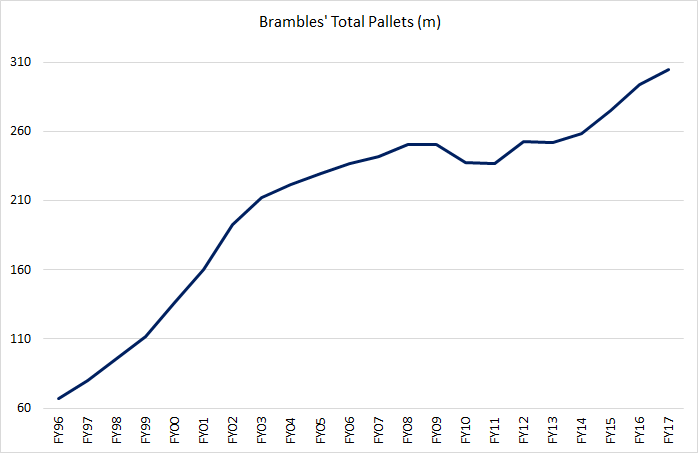

Brambles first listed in Australia in 1954, as W E Bramble & Sons Limited and entered the pallet pooling business in 1958 through the purchase of the Commonwealth Handling Equipment Pool (CHEP), from the Australian Government. Through a series of acquisitions, joint ventures and green field expansion into different countries and the investment of billions of dollars in pallet pools, warehouses and distribution centres Brambles has grown to be the largest supplier of pallets in the world over its 64-year history. Today, from its humble beginnings in Australia, Brambles has over 300 million CHEP pallets throughout the US, Europe and Australasia.

Chart 2: Brambles’ pallets growth over time

Source: Brambles and IML. Date: July-95 to June-17

Brambles has very strong competitive advantage in the markets it operates in thanks to its scale, unique network and reach. In recent times Brambles share price has weakened significantly as investors are concerned over the impact on margins from elevated transport costs (driven by higher oil prices), increased labour costs in the US as well as higher timber prices.

We believe Brambles, which is now trading on around 16 times earnings appears reasonable value on a 3 to 5-year view for a number of reasons:

- Input price concerns are short-term – we believe that Brambles will be able to recover its higher input prices and restore margins through price rises in the years ahead. Many of its customers are totally reliant on Brambles’ unrivalled scale and network density for their operations.

- Cost-outs will improve margins – Brambles has embarked on a significant cost-out programme to introduce automation across a number of depots which will also improve margins over time and increase its profitability.

- Earnings throughout the cycle – the majority of Brambles’ earnings are derived from the renting of pallets to facilitate the movement of food and consumables from manufacturers to their supermarket customers such as Walmart in the US. As such Brambles earnings have proven to be very resilient throughout economic cycles.

Conclusion

IML has always focused on buying companies with the criteria of strong competitive advantage, capable management, recurring earnings that can grow at a reasonable price.

To a long term, prudent investor like IML, buying a well-established, quality company like Brambles and being patient makes sense, especially when the company is out of favour with most investors and its shares are trading on depressed multiples due to short-term issues. We believe that doing this is a much more sensible investment than investing in many exciting relatively new ‘growth’ stocks like A2 Milk, on multiples of over 40 times earnings, when there are valid doubts as to the sustainability of the company’s earnings in the longer term.

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (AFSL 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.