By Daniel Moore

READ

One of the most basic economic concepts is the relationship between the demand for a product and its price. Generally, as prices go up, demand falls. Conversely, when prices are low, demand increases and people buy more. So, if a product in a supermarket that is generally sold for $10 goes on sale for $5 for a limited time, people will generally buy more.

However, it’s an interesting peculiarity that many investors behave in the opposite way when it comes to the sharemarket. When the prices of shares are going down, most people seem to want to sell, while when share prices are going up, everyone wants to be a buyer.

Why do investors buy when prices are rising?

This is momentum investing – following the herd. When the herd is running, more and more investors pile in, which continues to drive even greater momentum until something breaks. We saw this phenomenon take hold of investors from 2009 until March 2020, as ultra-low interest rates drove all share prices higher. It took the Covid pandemic to break it.

When prices fall, the opposite occurs. Momentum investors tend to allow fear to take hold and sell out. This is the opposite of value investing, where investors calculate the fair value of a company’s shares and try to buy it at a low price relative to its value. For value investors, when markets, or individual companies, are overvalued, it can be a great time to sell and take profits for our investors. When markets or companies drop, it’s often a great time to buy quality companies that are undervalued.

This is IML’s style of investing. We focus on companies that we think are good value, but also good quality. We have identified four common characteristics of quality companies:

- A strong competitive advantage

- Recurring earnings

- Capable management

- The ability to grow earnings, and dividends, over time

In addition to this, we only invest in companies that we believe are reasonably priced.

Buy now, pay later – a classic case of momentum investing

As Covid dragged on and on, and people stayed at home, they looked for other ways to occupy themselves. With Covid stimulus swilling around the economy many people started paying attention to a new way of paying for things – buy now, pay later (BNPL). As usage increased, and media interest intensified, so did investor interest. A whole swathe of investors, particularly retail investors used to long bull markets and momentum, piled in. The higher the share price went it dragged in more and more investors, both retail and professional, as FOMO (fear-of-missing-out) took hold.

Zip Co Ltd (ASX:ZIP) was one of the early pioneers of BNPL, along with Afterpay.

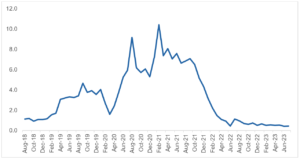

On 20 March 2020, a share of ZIP was worth $1.27

On 19 February 2021 it cost $12.35 (a 972% increase in under a year)

On 15 March 2022 it was back to $1.41

ZIP CO WEEKLY SHARE PRICE

When the hype dissipated BNPL was shown to be a classic investing fad driven by momentum investing. The companies involved, and their share prices, became disconnected from investment fundamentals. The reality was BNPL companies are very capital-intensive and they were as a whole not profitable. As interest rates started rising capital became more expensive, and as the BNPL companies were still burning through money their shine wore off. Investors started exiting and Zip Co plunged from a valuation of $7.7 billion on 16 February, 2021 to $347 million on 16 June, 2022 – 16 months later.

Investors who bought at the peak and cashed out some time in 2023 would have lost more than 95% of their money. While many people foresaw the BNPL companies share prices’ crashing, very few worked out exactly when this would happen. This is what makes momentum investing so risky.

Investors look at value, speculators study momentum

While buying good-quality companies, which are fundamentally good value, does not protect investors from market corrections, these companies tend to drop less when markets fall and recover better over the long-term. We have managed our clients’ money in this way through various market cycles over the past 25 years, including several booms and busts, as well as times when momentum investing was prevalent and fundamental valuations were ignored.

Whatever is happening in markets, we think for long-term investors the best approach is to focus on the fundamental value and quality of the company you are considering investing in, not the momentum of its share price. History has shown that quality companies which represent fundamental good value, drop less in a market correction. These companies also tend to recover faster, deliver better returns over the long-term, and pay consistent dividends.

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited ABN 60 088 786 289 AFSL 246830 and includes information provided by third parties, including Investors Mutual Limited (“IML”) AFSL 229988. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third party, except for liability under statute which cannot be excluded. The material is for general information only and does not take into account your personal objectives, financial situation or needs. You should consider, and consult with your professional adviser, whether the information is suitable for your circumstances. Past investment performance is not a reliable indicator of future investment performance and that no guarantee of performance, the return of capital or a particular rate of return is provided. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML. Statements of opinion are those of IML unless otherwise attributed. Except where specifically attributed to another source, all figures are based on IML research and analysis. Any investment metrics such as prospective P/E ratios and earnings forecasts referred to in this presentation constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold that stock. Any commentary about specific securities is within the context of the investment strategy for the given portfolio.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.