READ

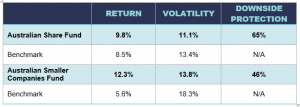

IML’s two flagship funds, the Australian Share Fund and Australian Smaller Companies Fund, celebrated their 25-year anniversaries this month. Over 25 years they have delivered our investors better returns than their benchmarks, with better downside protection and lower volatility*.

- The Australian Share Fund has returned 9.8% per annum since 1998, after fees, 1.3% above its benchmark while, on average, falling 35% less than its benchmark on months when it falls.

- The Australian Smaller Companies Fund has returned 12.3% per annum since 1998, after fees, 6.7% above its benchmark while, on average, falling 54% less than its benchmark on months when it falls.

The funds launched on June 30, 1998, in the same year Anton Tagliaferro founded IML as a ‘true to label’ value manager, with a strong focus on quality. However, 1998 was a tough time to attract investors to a value and quality fund. Google was founded in 1998 and the ‘Tech Boom’ was in full swing. Unprofitable dot.com stocks were becoming all the rage. It wasn’t until the ‘Tech Wreck’ started in March 2000, and share markets plunged around the world, that many investors started returning to investment fundamentals. In 2002, as the fallout from the Tech Wreck continued, the ASX 300 fell 8.64%, while IML’s Australian Share Fund was up 4.25%.

IML Chief Executive Damon Hambly, says that IML’s value and quality investment style is just as relevant today as it was in IML’s early days:

“IML’s style of investing is particularly well suited to periods of higher sharemarket volatility and economic uncertainty, like we are experiencing right now. We have a strong track record of both protecting clients’ capital during market declines and delivering returns with lower volatility. We are also proud of our history of active ownership – of standing up for shareholders, and challenging boards and senior management when we believe shareholders’ best interests are not being served.”

IML’s flagship funds – 25 year track record

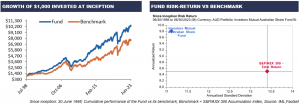

The success of this investing style can be seen in the figures below. While IML’s funds lagged their benchmarks during several periods of strong performance over the 25-year time frame, the way they have protected clients’ capital (downside protection) during sharemarket downturns has meant they have performed better over the long-term.

IML funds – performance vs benchmarks 1998 – 2023*

Past performance is not a reliable indicator of future performance.

This track record of protecting clients’ capital, of carefully balancing risk and return, has meant that if you invested money in IML’s funds back in 1998, it is now worth far more than if you invested it in the comparable benchmark.

- $10,000 invested with the Australian Share fund in 1998 would now be worth $103,757, after fees, $26,783 more than its benchmark.

- $10,000 invested with the Australian Smaller Companies fund in 1998 would now be worth $179,779, after fees, $140,960 more than its benchmark.

Australian Share Fund 25-year history

Australian Smaller Companies Fund 25-year history

Simon Conn is Senior Portfolio Manager for the Australian Smaller Companies Fund. He has been at IML since the company launched, and worked with Anton to put in place the investment processes and frameworks that continue to this day. Speaking about the fund’s 25th anniversary, he said:

“New funds are launched all the time, so to have achieved such a great track record of returns over 25 years is a real vindication of our investment style. What is more satisfying to me than the numbers though, is the way these returns have been delivered.

There are a lot of low-quality companies in the smaller end of the market, so our disciplined focus on quality companies with a strong competitive advantage, recurring earnings and capable management which are trading at reasonable prices has helped us grow capital over time, while protecting our clients’ capital during more difficult times.

Another pleasing outcome of the fund has come from our focus on profitable companies that pay dividends, this has allowed the fund to continually generate income from its underlying investments and enabled us to pay a distribution every six months since 1998.

I’d like to thank all of our clients who have trusted us with their hard-earned savings for so many years, we hope you will continue to trust us for many years to come.”

Daniel Moore and Hugh Giddy are the portfolio managers for IML’s Australian Share Fund, both joining the firm in 2010. Commenting on the fund’s anniversary Hugh said:

“It’s a responsibility that Daniel and I take very seriously, managing a fund with such a long, proud history that has played a key role in many of our clients’ investment portfolios.

I think the key to our success over so many years has been sticking to the investment philosophy that we know works – our relentless focus on both quality and value – while at the same time continuing to improve our investment processes.”

DOWNLOAD MEDIA RELEASE*Benchmark for the Australian Share Fund is the ASX 300 Accumulation Index and benchmark for the Australian Smaller Companies Fund is the ASX Small Ordinaries Index, excluding property trusts. Stats are from 1 July, 1998 to 1 July, 2023. Sources: Morningstar Direct, IML.

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (IML) (AFSL No. 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is general in nature and does not constitute personal advice. This advice has been prepared without taking account of your personal objectives, financial situation or needs. Investors should be aware that past performance is not a reliable indicator of future performance. The fact that a particular security may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock. Any reference to a particular security is general in nature and should not be taken as an endorsement by IML. IML is the responsible entity for the IML Funds. A product disclosure statement (PDS), target market determination (TMD) and Investment Guide are available at www.iml.com.au. Prospective investors should consider the PDS and TMD before deciding whether to invest, or continue to invest, in the Fund.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.