By Tuan Luu

READ

There are many different ways of making money in the stock market, but at IML the one thing we’ve found most consistently generates winners is significant moments of change. When a company, an industry, or society goes through a major change then this creates opportunities for investment. The trick is in figuring out exactly how to make the most of this change while controlling for risk.

For our Private Portfolio Fund one area of change we often focus on is corporate events – mergers and acquisitions (M&A), capital raisings, buybacks, IPOs, demergers and others. After a corporate event is announced, we always ask ourselves two questions before deciding whether or not to get involved:

- Who are the potential winners and losers?

- What’s the best way to take advantage of the event, while managing the risks?

Understanding the corporate capital cycle

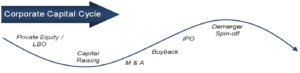

Like many things, corporate events tend to be cyclical. Companies go through similar stages in the corporate capital cycle as they make decisions on how best to optimise their balance sheets and return on capital.

Profiting from the Corporate Capital Cycle

The cycle is also influenced by broader trends in the economy and society – things like market conditions, cost of capital, investor appetites and regulatory changes. During the Covid pandemic many companies recapitalised as they required extra capital to cope with short-term pressures, or they hoarded excess capital in case they needed it. While interest rates were at all-time lows many companies took on extra debt, but as interest rates rose most publicly listed companies chose to raise money through capital raisings (issuing new shares to investors). There was $166 billion worth of secondary capital raisings in Australia in calendar year 2022, almost twice as much the calendar year before.

As we can see from the corporate capital cycle, a wave or capital raisings is normally followed by a wave of M&A, and this is exactly what we are seeing. Companies need to use this extra capital in some way, and when you add the increasing amounts of money being held by private equity, and an increased desire from investors, we have seen a large number of M&A deals over the past year, some of which could be opportunities for investors.

Our Private Portfolio Fund follows the corporate capital cycle and we opportunistically use it to deliver positive returns for our clients by exploiting the market’s tendency to over or under-react to corporate events. We employ a number of strategies to exploit these events, but they’re all based on trying to find the optimal balance of risk and reward for each event – to earn positive returns with a manageable level of risk. We don’t always follow the most obvious path, which can be crowded and often doesn’t have a very good risk/reward balance. Instead, we ask ourselves who are the potential winners, and what’s the best way to take advantage of it while managing the risks. In the last couple of years, M&A has proved fruitful.

BHP and Oz Minerals – an M&A upside participation strategy

A good example is the BHP and Oz Minerals (OZL) deal.

- BHP approached OZL in August 2022, offering $25 per share, 30% above the share price at the time of $19.

- Oz Minerals rejected the offer straight away, saying it wasn’t enough.

- Very quickly after the bid, the OZL share price jumped to $25.

We didn’t own OZL at the time, but after the announcement we started analysing the deal. BHP was clear that it wanted to buy OZL to strengthen its nickel and copper portfolio. These minerals are critical for electric vehicles and it would enable BHP to be a much bigger player in the energy transition. The deal also made economic sense from the operational synergies both parties share in South Australia and Western Australia.

From a risk viewpoint, we also couldn’t see any reason the deal wouldn’t go ahead politically. There was no clear reason for the Australian government to deny the acquisition, whether on competition grounds or due to concerns of a foreign company owning rights to some of Australia’s critical minerals. Moreover, BHP showed its commitment to the deal by purchasing 5% of OZL via derivatives.

Our fundamental M&A deal analysis indicated that BHP may need to increase its bid between 12% to 20% to win OZL. This was based on factors including OZL being highly leveraged to the copper price, which was trading at US$3.55/lb compared to our long-term target of US$4.25/lb, as well as the way OZL’s assets fit within BHP’s future strategy.

Due to the strategic benefits of the deal to BHP, and the financial benefits to both parties, we determined that it was likely that BHP would increase its bid and the deal would go ahead. And while there was downside risk (around 10%) our analysis indicated this was a lower probability outcome and the risk was manageable, so we wanted to be a part of the deal.

We then needed to work out the best way to be involved from a risk/reward perspective and we settled on an ‘upside participation’ trade. Using BHP’s initial $25 bid as a guide for the price of OZL we:

- Sold OZL $24.50 put options (just under BHP’s bid) to help fund the deal

- Bought OZL $26.00 call options (to participate in any upside)

So, if the share price fell below $24.50 we would have needed to buy the stock, but if the deal went ahead with an increased bid we could buy in at $26 and profit.

Oz Minerals share price during M&A deal flow

BHP waited until after OZL’s third quarter 2022 production report, to gain extra confidence in its bid, and then lifted its offer by 13% to $28.25 in November 2022. This bid won the support of OZL’s Board of Directors and we exercised our OZL $26.00 call options to buy the stock at a significant discount to the revised deal terms. As part of the deal, OZL declared a $1.75 special dividend with an additional $0.75 of franking credits.

Our total return on the deal return worked out to be 11%, based on a total return of $29.00 against our entry price of $26.00, with the premiums of the put and call options roughly matching.

Before you enter a corporate event, understand both the upside and downside

In any corporate event there are a number of different ways of playing the same opportunity. Before buying in, we think it’s important to understand:

- the rationale for the deal

- who might win or lose

- the likelihood of the deal going ahead, and how much you may lose if it breaks

- and the best way to take advantage of the deal while controlling for risk

In corporate events we have made money through complex means, like options and long/short trades, but we’ve also made money in simpler ways. For example, in an M&A deal it can benefit related companies outside the deal, competitors, allies, or suppliers, through better competitive positions or increased sales. For any opportunity though it’s important to work out both not only the potential rewards, but also the risks. If the deal breaks, what are you likely to lose? Is the deal so crowded that you may not be able to exit with a manageable loss if things turn sour?

While any investment holds risk, when you understand that risk you’re in a better place to manage its upside and downside potential. While corporate events can be risky for investors, we’ve found them a happy hunting ground for investment opportunities over the years, when played the right way.

Find out how IML’s Private Portfolio Fund delivers consistent returns with lower volatility than the ASX

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (IML) (AFSL No. 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is general in nature and does not constitute personal advice. This advice has been prepared without taking account of your personal objectives, financial situation or needs. Investors should be aware that past performance is not a reliable indicator of future performance. The fact that a particular security may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock. Any reference to a particular security is general in nature and should not be taken as an endorsement by IML. IML is the responsible entity for the IML Funds. A product disclosure statement (PDS), target market determination (TMD) and Investment Guide are available at www.iml.com.au. Prospective investors should consider the PDS and TMD before deciding whether to invest, or continue to invest, in the Fund.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.