By Daniel Moore & Lucas Goode

READ

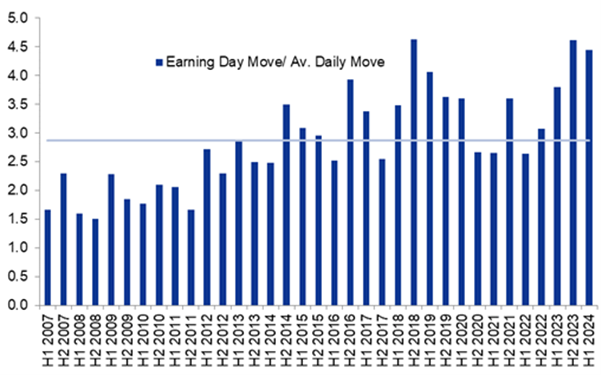

Another reporting season is nearly upon us. During this time, the temptation can be to succumb to the noise, fixate on backwards-looking numbers and miss the things that really matter when valuing companies. With an uncertain economic landscape and investors feeling more anxious than usual about the near-term outlook across Australian equities, we anticipate some big moves in individual companies this reporting season – some warranted, some not. Outsized result-day moves have become an increasingly common occurrence during reporting season, partly due to technical reasons such as increased quant and algorithmic trading activity, and we expect this to continue in August.

Earnings day vs 30D average daily move, ASX200 |

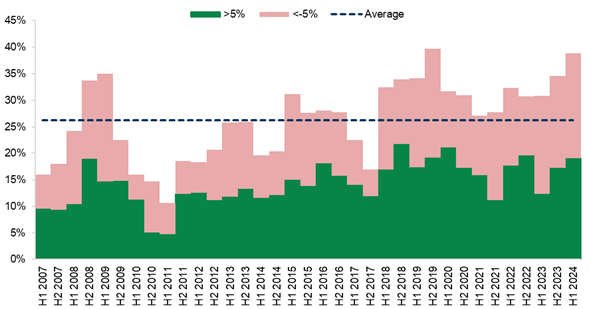

ASX200 stocks moving by >5% on earnings day |

|

|

| Source: Goldman Sachs | Source: Goldman Sachs |

One thing we will certainly be watching closely is the strength of the consumer and how this flows through to company profits and margins, particularly for domestic cyclical companies. There are, however, a number of other factors we’ll be paying close attention to throughout reporting season as we outline below.

Is the consumer finally starting to buckle – how will this impact profits?

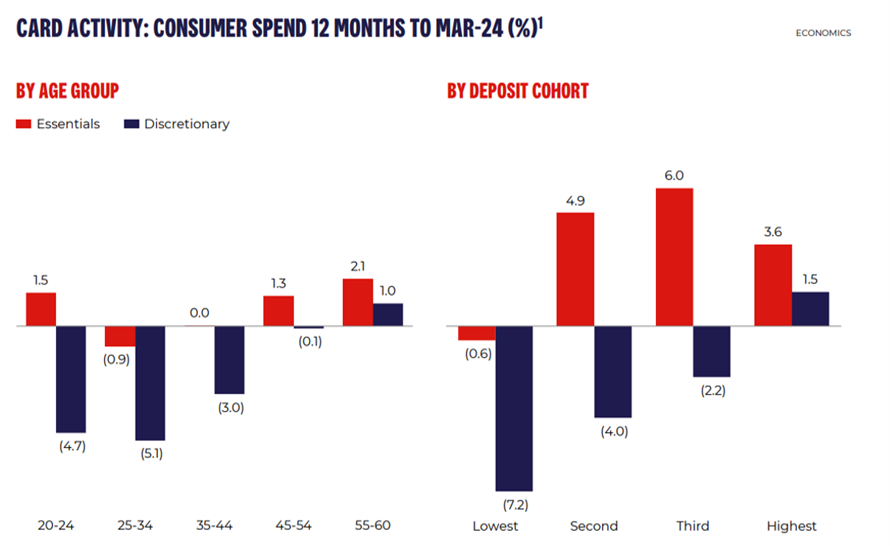

We have been talking for some time about how consumer spending is likely to slow, as higher interest rates and inflation eat away at disposable income – particularly among younger and lower income people and mortgage holders. To date the consumer has been surprisingly resilient, but we are starting to see signs that the consumer is under pressure, as shown in the charts below.

|

| Source: Westpac. Card activity, 12-month rolling average percentage change |

While this chart is from March, the latest company feedback we have received is that spending has slowed further in recent months. We expect to see this show up in some company results, particularly domestic cyclicals and discretionary retailers. Immigration has been propping up demand and easing labour constraints over the past two years, but with immigration normalising, this tailwind is reducing. We will be watching not just the impact this has on top-line revenue, but also on the bottom line, to see whether companies have been increasing discounts to boost sales, but then suffering lower profits and margins.

We saw many companies report slower sales figures and downgrade earnings forecasts towards the end of the financial year – including JB Hifi, Super Retail Group and Bapcor – even some fast-food retailers are feeling the pinch. With inflation still high and showing no signs of a rapid retreat to target range, cost pressures remain – whether wages, electricity, insurance or rent. Which companies will be able to maintain their margins by passing these costs through to their customers, and which will not, will be of great interest.

Dividends likely to divide along sectoral lines

We expect dividends to broadly hold up pretty well during this reporting season, with some exceptions. It’s important to remember that dividends are paid based on the underlying profitability of the company, not its share price.

The financial sector – particularly banks and insurers – are likely to pay solid dividends in general. While the share prices of many banks are sky-high, they have strong balance sheets and capital positions and appear to have bad debts under control. Insurance company margins also look healthy, as premium rates are up and they haven’t suffered excessively through increased claims. Higher interest rates have also boosted their investment income and therefore profits.

Resources companies on the other hand, might struggle to maintain their recent dividend form. Iron ore companies in particular are struggling with lower iron ore prices and reduced demand due to a softer outlook in China.

Growth has outperformed value, will it continue?

Many growth stocks have materially outperformed value stocks this year, particularly those related to the AI and data centre thematic. It will be interesting to see if these companies meet the high expectations of investors, and if they don’t whether they will be punished or not. With US Reporting Season underway we have seen the first signs of investors worrying about the ability of highly-priced AI-related companies to deliver increased earnings in line with the increased capital they are spending on AI. With high share prices comes high expectations and reporting season is always a reality check to see whether business performance aligns with share price performance. The AI thematic still has a long way to play out, so it’s unlikely this reporting season will give us a definitive answer either way.

Where we might see substantial moves is in companies that aren’t aligned to any exciting long-term growth thematics and where high valuations haven’t been matched with higher earnings. Australian banks, for example, have seen their share prices rise around 40% since October, but their earnings are pretty flat. The share price moves after the banks report could be illuminating.

Myopic focus on results likely to provide opportunities in small caps

Small caps materially underperformed the ASX100 over 2022 and 2023 (by around 30% cumulatively). While they have performed better this year, small caps haven’t appreciably closed the gap as yet in Australia. This is in stark contrast to the United States, where the Russell 2000 Index of smaller companies has outperformed the Nasdaq Composite Index by over 10% in July as the market has begun to position for imminent rate cuts. Unfortunately for both Australian small caps (and mortgage holders!), with inflation remaining stubbornly high in Australia we may not be there just yet. Regardless, we see a lot of value on offer in small cap industrials at present on both an absolute and relative basis.

The high reporting season volatility mentioned earlier is likely to be even more acute in smaller companies, due to lower liquidity and typically larger beats and misses. On results day itself, as well as the weeks leading into reporting season, stocks often trade largely on near term (or even backwards-looking) earnings rather than on an appropriate valuation of the fundamentals and long-term opportunity of the business.

Overreactions to sometimes temporary issues (both positive and negative) can create great opportunities for small cap investors with a longer-term view. An example in our portfolios is bus operator Kelsian, which has been heavily sold off since its last result on temporarily higher labour costs due to bus driver shortages and a delayed (since re-started) LNG project that it is servicing in North America. In our view neither of these issues materially impact the long-term value of the company’s infrastructure-like contract book, yet the stock has underperformed the Small Ordinaries Index by 26% since February. We expect August’s reporting season to throw up plenty of buying opportunities like this.

With an uncertain economic outlook, expect volatility and opportunity

The domestic economy is fragile right now – inflation isn’t under control, consumers are under pressure and costs for businesses remain high. This has created a greater-than-normal level of ambiguity around near-term company earnings and margins. The way the market has reacted to that so far is by piling into companies with perceived certainty around an increasingly narrow segment of the market (and perhaps overpaying for them). We believe many quality companies with attractive long-term prospects have been unfairly left behind. This reporting season it will be interesting to see if the companies which have out-performed significantly in recent times meet the high expectations built into their share prices, and vice versa. As always, we expect this reporting season to create both volatility and opportunities for long-term, value-focused investors that are good judges of companies’ intrinsic worth.

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited ABN 60 088 786 289 AFSL 246830 and includes information provided by third parties, including Investors Mutual Limited (“IML”) AFSL 229988. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third party, except for liability under statute which cannot be excluded. The material is for general information only and does not take into account your personal objectives, financial situation or needs. You should consider, and consult with your professional adviser, whether the information is suitable for your circumstances. Past investment performance is not a reliable indicator of future investment performance and that no guarantee of performance, the return of capital or a particular rate of return is provided. You should consider the information contained in the Product Disclosure Statement in conjunction with the Target Market Determination, available at www.stg-imlimited-staging.kinsta.cloud. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML. Statements of opinion are those of IML unless otherwise attributed. Except where specifically attributed to another source, all figures are based on IML research and analysis. Any investment metrics such as prospective P/E ratios and earnings forecasts referred to in this presentation constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold that stock. Any commentary about specific securities is within the context of the investment strategy for the given portfolio.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.