By Anton Tagliaferro and Nigel Hale

READ

Few Australian large-cap stocks have caused as many differences of opinion over company prospects as Telstra.

Telstra has been Australia’s largest and most profitable telco and a solid dividend payer. Yet, despite this, Telstra’s shares have been disappointing performers since the company was floated on the ASX following an offer of shares from the Federal Government in 1997 at the $3.30 level. Intense competition, new technologies and the Government’s decision to build the NBN have all impacted the sector and Telstra – particularly over the last decade.

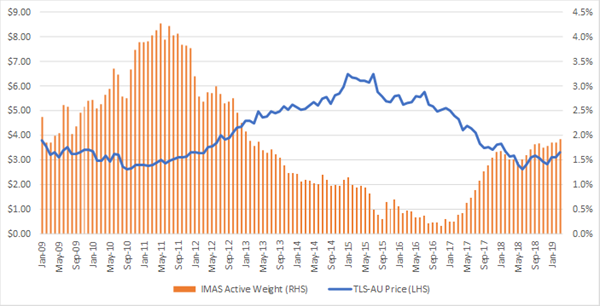

Given its position as Australia’s number one telco, its ability to pay solid dividends and its strong balance sheet, Telstra shares have always been of interest to IML. We have used the gyrations in the company’s shares to accumulate when sentiment towards the company was poor and the stock appeared undervalued to us – and similarly, we have reduced our holding when sentiment towards Telstra was strong and the shares were looking fully priced as shown in the chart below.

IML Australian Share Fund’s weighting in Telstra relative to share price

Source: IML company data as of 31 March 2019

As shown above, IML built up a significant position in the company between 2009 and 2011 as Telstra’s shares wallowed at or below $2.80. The company was embroiled in a dispute with the Federal Government over the NBN rollout at the time.

The dispute was eventually resolved and Telstra’s mobile earnings grew strongly as 4G was rolled out from 2012 onwards. As a result, Telstra’s shares rallied to peak at over $6 in 2015, where they settled for most of 2016.

During that period, IML reduced its exposure to Telstra significantly because, in our view, the shares appeared fully valued as many investors took too optimistic a view of the company’s prospects. We also saw the potential negative impact of the NBN on Telstra’s earnings from its monopolistic, fixed-line business. As a result, we saw Telstra’s need to transform and restructure its business to plug the NBN-related earnings vacuum.

Current IML portfolio positioning and rationale

IML has increased its holding in Telstra’s shares again over the last couple of years as the price slumped again towards the $2.80 level.

This fall was caused by caution over Telstra’s earnings as the NBN rolled out and as it became apparent that mobile competition had increased significantly. As a result, Telstra reset its dividends. Adding to the NBN challenge, the announcement in 2017 of TPG’s ambitious plans to become Australia’s 4th mobile network provider also weighed heavily on Telstra’s share price.

So why, as shown in the chart above, did IML increase its weighting recently to Telstra in its portfolios? In our view, investors adopted an overly pessimistic view of Telstra’s prospects. While we didn’t pick the absolute bottom, we believed Telstra shares were good buying around the $3 level as IML’s bottom-up fundamental analysis identified five significant factors that we believed would build long-term value for Telstra shareholders:

1. Telstra is in the throes of a $2.5 billion cost-out programme

Due to the advent of NBN, the profitability of Telstra’s fixed-line networks will decline markedly as the NBN is rolled out. To offset this loss of profits, Telstra has announced that it will reduce its cost base by $2.5 billion – mainly by reducing its head count. It plans to shed 8,000 permanent jobs and 10,000 contractors’ roles. While the reduction in the headcount is very difficult for staff affected, it is entirely necessary for Telstra to remain competitive in the ever-changing telco sector.

2. NBN has agreed to rental payments to Telstra of $1 billion per annum for the next 30 years

NBN requires access to many of Telstra’s pits, ducts and exchanges for the operation of its network. Telstra agreed to give NBN co-access under a 30-year lease. Telstra will receive rental payments reaching approximately $1 billion per annum when the NBN rollout is complete, and the payments will grow with inflation thereafter. This rental payment was negotiated as part of the Telstra/NBN deal in 2011 and is effectively a highly valuable income stream owing to its inflation-proof, long-term lease structure and government-supported credit quality. We believe the value of this income stream will be more readily recognised as earnings from Telstra’s infrastructure division – which Telstra has called InfraCo – become more visible to investors.

3. Share price will rise as Telstra rolls out its 5G network well ahead of competitors

Telstra is ahead of its competitors in its 5G network rollout, in part because it has been working closely with Ericsson to build its network. Meanwhile, Optus and Vodafone’s network rollout plans have been dealt a blow because of the Australian government’s ban on Chinese telecommunications giant Huawei, which was the principal technology supplier for Optus and Vodafone’s mobile networks.

Telstra will thus be able to transition smoothly from 4G to 5G thanks to its heavy investment in Ericsson’s equipment and transformative technology. Telstra launched its initial 5G mobile services across Australian capital cities earlier this month while Optus and Vodafone’s 5G plans remain uncertain at this stage given the Huawei ban.

Besides its 5G head start, Telstra also has the lead in another area. It has struck an exclusive deal to offer Samsung’s first 5G handset, the new S10. Leadership in both 5G network rollout and handset availability puts Telstra in a strong position to supply 5G services.

4. Telstra earnings have scope to improve when a more rational mobile market eventuates

Over the past three years, Telstra, Optus and Vodafone have been locked in a price war in mobile with Optus driving prices lower in a bid to gain market share. Mobile prices in Australia are now amongst the lowest in the world. In our opinion, this heavy discounting does not appear to be sustainable and it may well reverse in coming years.

Vodafone Australia is now loss-making while TPG announced that it no longer plans to build a mobile network, and instead, the company is focused on merging with Vodafone. In addition, after having made large investments in network capacity and sports content rights, Optus’ underlying net profit in the first nine months of FY19 fell by about 25% compared to three years ago, and net debt has risen from around $2.8 billion to $3.8 billion over the same period.

Our expectation is that Optus will require higher mobile pricing to justify its large investments in the 5G rollout and to sustain its dividends to its parent Singtel. Financial constraints faced by competitors will put upward pressure on industry pricing and in our opinion, improved conditions should allow Telstra to improve earnings from its mobile division.

5. Telstra will benefit from a more rational fixed-line market as competitors drop out

Telstra currently makes zero margin reselling NBN broadband services due to strong competition. However, its competitors are also feeling the pain, and some have decided to leave the market.

Vocus, operating primarily through the Dodo brand, is the fourth largest broadband provider in Australia. In February, Vocus announced it was no longer seeking new customers on the NBN network due to the unattractive economics. Amaysim, a very low-cost online operator, has also announced that it is exiting the NBN resale market.

Telstra has used its financial strength to maintain approximately 50% of the broadband market during the NBN rollout. We expect Telstra’s margins on this business to improve as competition becomes more rational over the longer term.

Conclusion

While the telecommunications industry remains very competitive in many areas, we believe that Telstra is making all the right long-term, strategic decisions and is well placed to benefit as industry conditions improve in the years ahead. We are happy to retain Telstra as a core holding in IML portfolios.

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (AFSL 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.