By Lucas Goode

READ

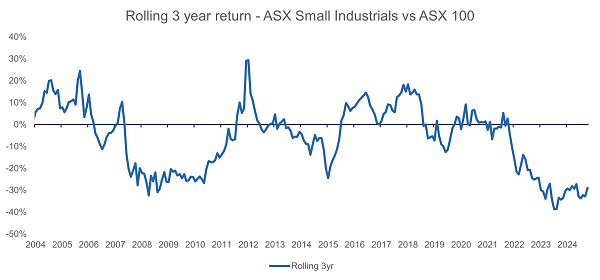

2024 was a strong year for stock markets in US and global markets and here in Australia. While equities have performed well, the rally has been fairly narrow. Globally, mega-cap tech has been very strong, while in Australia the big banks and some richly-priced technology stocks have driven much of the gains. Smaller companies have also performed well over the past 12 months, but still haven’t closed the performance gap with larger companies that has opened up over the past three years.

Source: Factset, as of 17 January, 2025

In addition to the relative underperformance of small caps versus large caps since 2022, we also highlight a higher than average dispersion between the highest-priced stocks and lowest-priced stocks. This is particularly apparent in the smaller end of the market, where we continue to find high-quality, well-priced stocks to buy.

Three small caps that are well positioned to continue to perform well in 2025 are discussed below. These companies are all reasonably priced, benefit from long term structural tailwinds and should prove resilient in the face of any broader cyclicality in the domestic economy over the next 12 months. All three are top ten holdings within the IML Australian Smaller Companies Fund.

Hansen Technologies: A global billing software provider

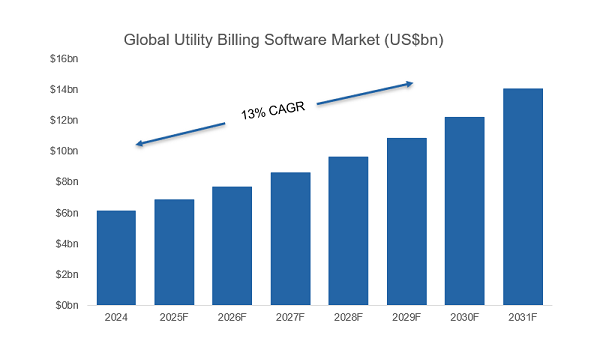

As western countries attempt to decarbonise their energy production, adding intermittent renewables and energy storage, electricity grids are becoming increasingly complex. Not only does this make managing transmission and distribution networks more difficult for utilities, but billing is also becoming more complicated in a world of smart meters and large fluctuations in electricity prices. As a result, utilities across the world are being forced to modernise and upgrade their software.

Hansen Technologies is a global provider of billing and customer care software to the energy and communications sectors. The increasingly dynamic nature of energy markets is driving higher demand for Hansen’s energy products. Organic revenue growth in Hansen’s Energy & Utilities business was 15% in FY24, well above its historic mid-single digit growth rate as customer uptake of Hansen’s newer cloud native solutions accelerates.

Source: Verified Market Research, 2024

The company recently entered Europe’s largest energy market with the acquisition of German business Powercloud. Powercloud’s financial performance had deteriorated under its previous owner as a result of an ill-advised global expansion, however under Hansen’s ownership it has now returned to profitability and refocused on the large opportunity in its home market. This is in keeping with Hansen’s long history as a disciplined acquirer of complementary businesses, with a strong track record of performance and margin improvement as the acquired companies are “Hansenised”.

Hansen is well positioned to demonstrate accelerating organic growth and expanding margins in the next two years, driven by improving profitability at Powercloud, growing energy utility technology requirements and potential success in large tenders within its Communications segment. Trading on 15x FY26 free cash flow with a strong balance sheet, we see ample scope for a re-rating.

Integral Diagnostics: Australia’s second largest radiology provider

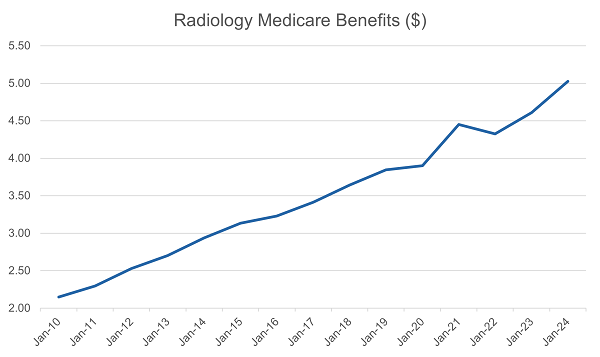

Another long-term structural trend in Australia (indeed in most developed countries around the world) is an ageing population. Integral Diagnostics, after its recent merger with Capitol Health, is the second largest radiology provider in Australia. Medicare funded radiology volumes have grown at a +4% compound annual growth rate over the past 15 years, a rate well ahead of population growth. Volumes more recently have recovered following Covid, and we think it’s likely this growth rate will accelerate in future, due to the increasing need that Australia’s ageing population will have for more frequent medical testing.

What is also notable is that Medicare radiology expenditure, or benefits, has grown at a higher +6% compound growth rate over the same period, given the indexation applied to Medicare payments. This is highlighted in the chart below, which shows that Medicare benefits in radiology have increased by almost 150% over the past 14 years.

Source: Australian Bureau of Statistics, 2024

IDX’s investment in technology and strategic M&A sees it well placed to benefit from growth in the sector. The company’s merger with Capitol should yield significant operational benefits, while a strong balance sheet provides scope for further accretive acquisitions. IDX is currently trading on around 8x FY26 EV/EBITDA, a material discount to recent private transactions in the space.

Austal: A prime US and Australian defence contractor

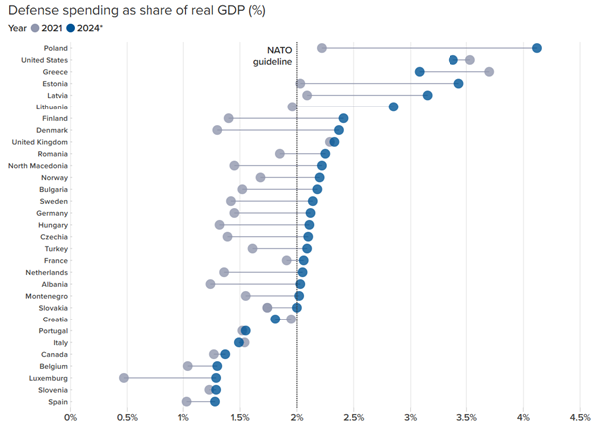

A less stable geopolitical environment is driving higher military spending globally, as shown in the chart of NATO military spending growth below.

A clear beneficiary of increased military expenditure is naval shipbuilder Austal, a prime defence contractor to both Australia and the United States. Austal’s modern and low-cost shipyard in Alabama is a crucial part of the United States’ military industrial base, something that was highlighted last year when the company was granted US$450m to build dedicated facilities for the construction of nuclear submarine modules under the AUKUS program.

In Australia, Austal has effectively been appointed as the Australian Navy’s single source shipbuilder under the Strategic Shipbuilding Agreement (SSA). Combined with its record A$13bn order book (excluding the SSA), Austal’s shipyards in both Alabama and Western Australia (as well as its San Diego support facility) are likely to be fully utilised well into the 2030s. Despite its strong outlook, Austal is currently trading at a material discount to net tangible assets (c$4.50 per share versus a current share price of around $3). We believe that the market vastly underestimates both Austal’s strategic importance to the US and Australian governments, and its earnings power as its record order book is converted into revenue.

All three companies discussed in this article have the characteristics we look for at IML. They have strong competitive positions, are capably run and have a solid growth outlook. All are relatively resilient to changes in the economic cycle and leveraged to long term structural tailwinds. And crucially, all are reasonably priced.

Lucas Goode is a portfolio manager for IML’s Australian Smaller Companies Fund which delivered an annual return of 20.0% after fees as at 31 December 2024, relative to the ASX Small Ordinaries index (ex-property) which returned 9.0% for the corresponding period.

Past performance is not a reliable indicator of future performance.

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited ABN 60 088 786 289 AFSL 246830 and includes information provided by third parties, including Investors Mutual Limited (“IML”) AFSL 229988. Although Natixis Investment Managers Australia Pty Limited believe that the material is correct, no warranty of accuracy, reliability or completeness is given, including for information provided by third party, except for liability under statute which cannot be excluded. The material is for general information only and does not take into account your personal objectives, financial situation or needs. You should consider, and consult with your professional adviser, whether the information is suitable for your circumstances. Past investment performance is not a reliable indicator of future investment performance and that no guarantee of performance, the return of capital or a particular rate of return is provided. You should consider the information contained in the Product Disclosure Statement in conjunction with the Target Market Determination, available at www.stg-imlimited-staging.kinsta.cloud. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML. Statements of opinion are those of IML unless otherwise attributed. Except where specifically attributed to another source, all figures are based on IML research and analysis. Any investment metrics such as prospective P/E ratios and earnings forecasts referred to in this presentation constitute estimates which have been calculated by IML’s investment team based on IML’s investment processes and research. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to either buy, sell or hold that stock. Any commentary about specific securities is within the context of the investment strategy for the given portfolio.

INVESTMENT INSIGHTS & PERFORMANCE UPDATES

Subscribe to receive IML’s regular performance updates, invitations to webinars as well as regular insights from IML’s investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

IML marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected by Natixis Investment Managers Australia, on behalf of IML. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.